Cash Envelopes Vs. Budgeting Apps – Which Is The Better Budgeting Tool For You?

With the rise of digital tools and financial apps, the age-old method of cash envelopes has found itself competing for attention in personal finance management. While budgeting apps offer convenience and real-time tracking, some still swear by the tried-and-true practice of physically dividing cash into envelopes for different expense categories. In this blog post, we’ll explore the pros and cons of each budgeting tool to help you decide which one may be the better fit for your financial goals and lifestyle.

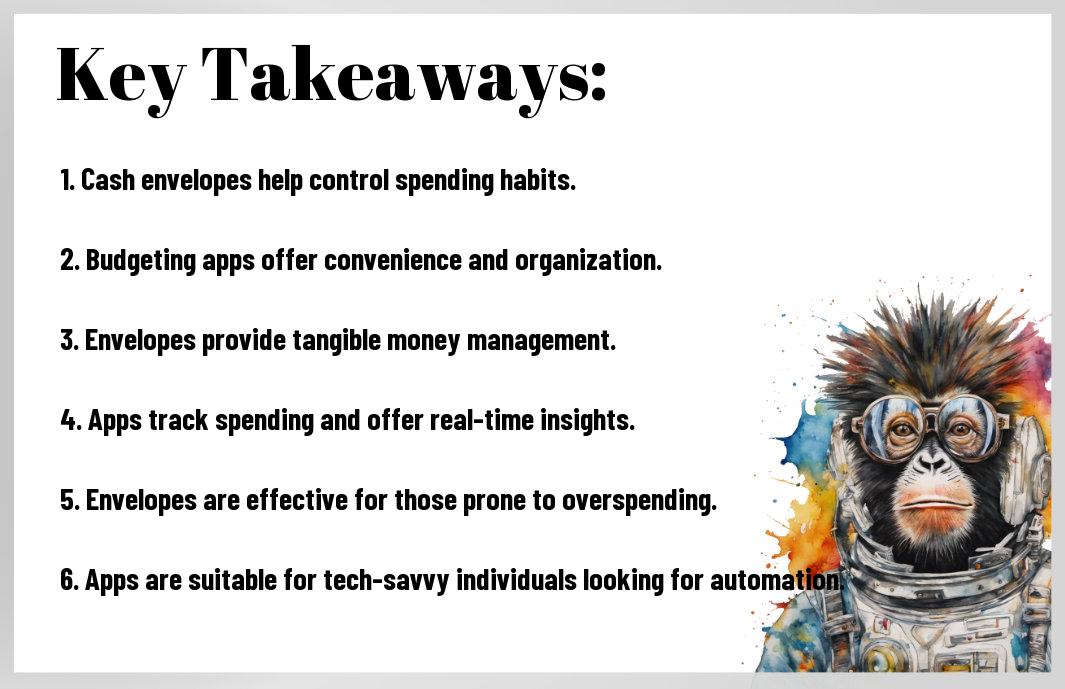

Key Takeaways:

- Cash Envelopes: Ideal for those who prefer a physical representation of their budget and find it easier to control their spending with cash.

- Budgeting Apps: Great for individuals who prefer a digital platform with features like automatic tracking, categorization, and visualization of expenses.

- Combination Approach: Some find success in using both methods, using cash envelopes for specific categories and a budgeting app for overall tracking.

- Personal Preference: The effectiveness of each tool depends on individual preferences, lifestyle, and financial goals.

- Experimentation is key: Try both methods to see which one aligns better with your budgeting style and helps you achieve your financial objectives.

Understanding Cash Envelopes

The Basics of the Cash Envelope System

You may have heard of the cash envelope system as a budgeting technique that involves using physical cash for different expense categories. Essentially, you allocate a certain amount of cash to designated envelopes for expenses such as groceries, entertainment, and transportation. Once the cash in an envelope is gone, you stop spending in that category until the next budgeting period.

Pros and Cons of Using Cash Envelopes

When considering the cash envelope system, it’s important to weigh the pros and cons to determine if it’s the right budgeting tool for you.

Pros

| Helps limit spending | Encourages mindful spending |

| Prevents impulse purchases | Improves financial discipline |

| Easy to track expenses | Helps prioritize financial goals |

Cons

| Risk of misplacing or losing cash | Not suitable for online transactions |

| Inconvenient for large purchases | Requires discipline to stick to the system |

While the cash envelope system has its advantages, such as enforcing spending limits and promoting conscious financial decisions, it also has limitations. Keeping track of physical cash can be cumbersome, and it may not be suitable for those who prefer online transactions or have difficulty adhering to strict budgeting guidelines.

Exploring Budgeting Apps

Once again, if you are considering using a budgeting app to manage your finances, there are a plethora of options available. For a comprehensive list of the ‘Best Budgeting Apps Of 2024’, check out Bankrate’s article here.

How Budgeting Apps Work

The functionality of budgeting apps varies, but most work by connecting to your bank accounts and credit cards to track your income and spending. They categorize your transactions automatically and provide visual representations of your financial habits through charts and graphs.

Advantages and Disadvantages of Digital Budgeting

Advantages of using digital budgeting apps include convenience and real-time tracking of your finances. However, these apps may pose security risks if not properly protected, and some users may find it challenging to stick to a budget without the physical presence of cash.

Budgeting apps offer users the convenience of managing their finances on the go, accessing real-time updates, and engaging visuals to track spending. However, they may come with security risks if they are not properly secured, and some users may find it difficult to control their spending without the tangibility of physical cash.

Comparing Cash Envelopes and Budgeting Apps

Ease of Use and Accessibility

| Cash Envelopes | Budgeting Apps |

| Cash envelopes are tangible and visual, making it easy to see how much money is allocated for each category. | Budgeting apps allow for convenient access to financial information anytime, anywhere, and often offer features such as real-time tracking and automatic categorization of expenses. |

Cash envelopes may require more effort in terms of physically dividing your cash and tracking spending, but some find the traditional method more straightforward and effective for sticking to a budget. Conversely, budgeting apps provide a digital platform that streamlines the budgeting process and offers a comprehensive view of your finances with just a few taps on your smartphone.

Effectiveness in Money Management

| Cash Envelopes | Budgeting Apps |

| Cash envelopes promote disciplined spending and limit the temptation to overspend, as you can only use the cash available in each envelope. | Budgeting apps offer sophisticated tools for tracking expenses, setting financial goals, and analyzing spending patterns, allowing for a more detailed and comprehensive approach to money management. |

Effectiveness in money management ultimately depends on personal preference and lifestyle. Cash envelopes are great for those who prefer a hands-on approach and benefit from the visual reinforcement of budgeting. On the other hand, budgeting apps provide a technological edge with automation and data analysis that can help individuals make more informed financial decisions.

Choosing the Right Tool for You

Your Financial Habits and Preferences

Not everyone manages their finances in the same way. Some people prefer the tangible nature of using cash envelopes, finding it easier to track their spending when they can physically see the money leaving their hands. On the other hand, budgeting apps offer convenience and the ability to track expenses in real-time, appealing to those who prefer a digital approach to budgeting.

Integrating Cash Envelopes and Budgeting Apps

To effectively integrate cash envelopes and budgeting apps, you can allocate budgets for different categories using the app and withdraw the corresponding amount in cash to place in your envelopes. This hybrid approach allows you to take advantage of the benefits of both methods, combining the discipline of cash envelopes with the convenience of tracking your transactions digitally.

Plus, by using both cash envelopes and budgeting apps, you can ensure that you have a comprehensive budgeting system that caters to your individual preferences and financial habits. This way, you can make informed financial decisions and stay on track towards your financial goals.

Conclusion

Considering all points, whether you choose cash envelopes or budgeting apps as your budgeting tool ultimately depends on your personal preferences and financial habits. Cash envelopes can be a tangible and effective way to control spending, especially for those prone to overspending or struggling to stick to a budget. On the other hand, budgeting apps offer convenience, automation, and the ability to track expenses more efficiently. It’s crucial to assess your spending behaviours, comfort with technology, and overall financial goals to determine which method aligns best with your needs. Whichever tool you choose, the most important aspect is to establish a budgeting routine and stick to it consistently to achieve your financial objectives.

FAQ

Q: What are cash envelopes?

A: Cash envelopes are a budgeting method where you allocate a specific amount of money for each spending category and place that cash in labelled envelopes. Once the cash in an envelope is gone, you cannot spend any more in that category.

Q: What are budgeting apps?

A: Budgeting apps are digital tools that help you track your income, expenses, and financial goals. These apps provide features such as budget tracking, expense categorization, bill reminders, and financial reports.

Q: How do cash envelopes help with budgeting?

A: Cash envelopes help with budgeting by providing a visual representation of your spending limits in each category. They encourage conscious spending, prevent overspending, and help you prioritize your expenses based on your financial goals.

How do budgeting apps help with budgeting?

A: Budgeting apps help with budgeting by automating the tracking of your finances, providing real-time insights into your spending habits, offering personalized budgeting tips, and helping you stay organized with your financial information in one central location.

Which is the better budgeting tool: cash envelopes or budgeting apps?

Both cash envelopes and budgeting apps have their pros and cons. Cash envelopes are great for those who prefer a tangible and visual way of managing their money and want to avoid overspending. On the other hand, budgeting apps are convenient for those who prefer digital tracking, automation, and detailed financial analysis. The best budgeting tool for you depends on your personal preferences, financial goals, and lifestyle.