Needs Vs. Wants – How To Make Better Spending Decisions In Your Budget

Identifying the difference between needs and wants is crucial when it comes to managing your finances effectively. By understanding the distinction between these two categories and learning how to prioritize them in your budget, you can make smarter spending decisions that align with your financial goals. In this blog post, we will provide you with practical tips and strategies to help you distinguish between needs and wants, ultimately empowering you to take control of your budget and make more informed financial choices.

Key Takeaways:

- Understanding the difference: Distinguish between needs and wants to make better spending decisions in your budget.

- Priority setting: Prioritize your needs over wants when budgeting to ensure financial stability.

- Consistent evaluation: Regularly review your expenses to identify areas where you can cut back on wants to meet your needs.

- Creating a budget: Allocate a specific amount for needs and wants in your budget to ensure you do not overspend on unnecessary items.

- Long-term financial goals: Keep your long-term financial objectives in mind when making spending decisions to avoid accumulating unnecessary debt.

Assessing Your Financial Situation

How to Track Your Spending

While it may seem like a tedious task, tracking your spending is crucial in understanding where your money is going. By keeping a record of every expense, whether it’s a cup of coffee or a monthly bill, you can get a clearer picture of your financial habits and make necessary adjustments to your budget.

Identifying Your Income vs. Expenditures

Any successful budget starts with knowing exactly how much money you have coming in and how much is going out. Take the time to list all your sources of income, including salaries, bonuses, or any other additional funds. Then, make a detailed list of all your expenses, from fixed costs like rent and utilities to variable expenses like dining out or shopping.

Spending: It’s important to ensure that your total expenses do not exceed your total income. If you find that you are consistently spending more than you earn, it may be time to reevaluate your spending habits and make necessary adjustments to achieve a healthy financial balance.

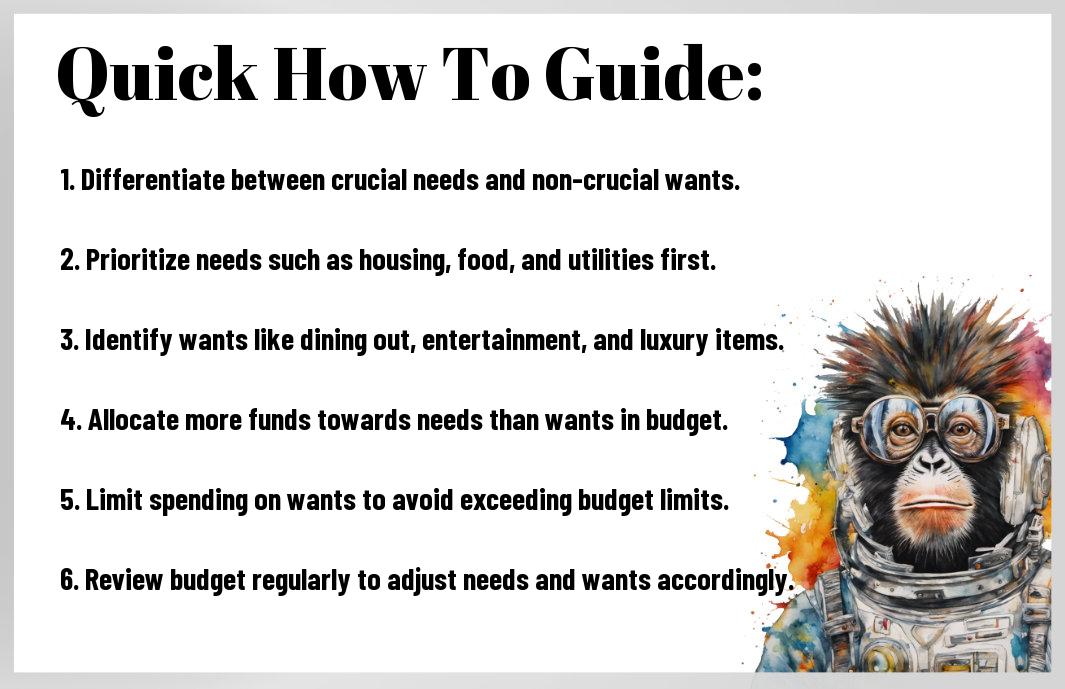

How-To Prioritize Your Spending

Tips for Prioritizing Needs Over Wants

Now, when it comes to prioritizing your spending, it is crucial to differentiate between needs and wants. One effective way to ensure you are prioritizing needs over wants is by making a list of your expenses and categorizing them accordingly. Start by identifying your imperatives, such as rent, utilities, and groceries, before moving on to non-imperative items like dining out or shopping for unnecessary items.

- Set a budget and stick to it

- Consider the long-term benefits of your spending choices

- Avoid impulse purchases by giving yourself a cooling-off period

Perceiving needs versus wants can be challenging, but by following these tips, you can align your spending with your financial goals and priorities.

Tools and Techniques to Help You Prioritize

With prioritizing your spending, having the right tools and techniques at your disposal can make a significant difference in how you manage your finances. One useful tool is a budgeting app that can help you track your expenses, set financial goals, and monitor your progress. Additionally, techniques such as the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings, can provide a structured framework for prioritizing your spending effectively.

Tools and techniques like these can empower you to make informed financial decisions and ensure that your spending aligns with your financial priorities and goals.

Factors Impacting Spending Choices

Unlike needs, which are crucial for survival, wants are driven by various factors that influence our spending decisions. These factors can vary from person to person and can include societal pressures, personal values, lifestyle choices, and emotional triggers.

- Societal Pressures: The desire to keep up with trends and maintain social status can lead to unnecessary spending on items we don’t truly need.

- Personal Values: Our individual values and beliefs play a significant role in determining what we consider important enough to spend money on.

- Lifestyle Choices: Our chosen lifestyle can impact our spending choices, as certain lifestyles may come with higher costs or societal expectations.

- Emotional Triggers: Emotional spending, influenced by feelings of stress, boredom, or happiness, can lead to impulsive buying decisions.

After considering these factors, we can make more conscious and intentional spending choices that align with our financial goals and priorities.

Emotional Spending and How to Avoid It

The temptation to make impulse purchases based on emotions can often derail our budgeting efforts. Recognizing emotional triggers and implementing strategies such as creating a shopping list, setting a budget, and giving yourself a cooling-off period before making a purchase can help avoid falling into the trap of emotional spending.

Long-Term Goals vs. Short-Term Desires

An important aspect of making better spending decisions is striking a balance between fulfilling short-term desires and working towards long-term goals. While enjoying life’s pleasures is crucial, it is equally important to prioritize saving and investing in your future financial security.

Long-term goals such as saving for retirement, buying a home, or funding your child’s education require careful planning and disciplined financial choices. By distinguishing between immediate gratification and long-term benefits, you can make informed decisions that align with your overall financial objectives.

Practical Tips to Improve Your Spending Habits

Despite the constant barrage of advertisements urging us to buy more, it’s necessary to distinguish between our needs and wants. To make better spending decisions in your budget, here are some practical tips to improve your spending habits:

- Avoid impulse purchases by making a shopping list before going to the store and sticking to it.

- Set financial goals and prioritize them in your budget to ensure you are meeting your needs before fulfilling your wants.

- Track your expenses regularly to understand where your money is going and identify areas where you can cut back.

Perceiving the difference between needs and wants is crucial for financial well-being. For more in-depth guidance on managing your budget effectively, check out Budgeting Needs vs Wants: A How-to Guide.

How to Create a Budget That Works for You

The key to creating a budget that works for you is to start by calculating your monthly income and fixed expenses. Then, allocate a portion of your income to savings and prioritize your necessary needs such as rent, utilities, and groceries. Make sure to leave room for discretionary spending on wants after covering your needs and savings.

Strategies for Making Responsible Purchases

Practical strategies for making responsible purchases include researching products before buying, comparing prices from different retailers, and waiting before making a purchase to avoid impulse buying. It’s also helpful to consider the long-term value of the item and its impact on your budget and financial goals before making a decision. By practising these strategies, you can make more informed and responsible purchasing choices that align with your financial priorities.

Conclusion

Presently, understanding the difference between needs and wants is crucial for making better spending decisions in your budget. By prioritizing importance such as housing, food, and utilities over non-important items, you can ensure that your finances are allocated wisely. Reflecting on your purchasing habits and distinguishing between what you truly need versus what you simply want can lead to more responsible financial choices and a more secure financial future. Incorporating this mindset into your budgeting practice will ultimately help you achieve your financial goals and lead to greater financial stability.

FAQ

Q: What is the difference between needs and wants?

A: Needs are imperative items or services required for survival and basic living, such as food, shelter, and clothing. Wants are non-imperative items or services that enhance our lives but are not necessary for survival, like luxury items or entertainment.

Q: How can I differentiate between needs and wants in my budget?

A: To distinguish between needs and wants in your budget, prioritize your expenses based on whether they are imperative for survival or simply add convenience or pleasure to your life. Needs should always come first when allocating your budget.

Q: Why is it important to prioritize needs over wants in budgeting?

A: Prioritizing needs over wants in budgeting ensures that you have enough resources to cover imperative expenses and maintain a stable standard of living. By focusing on needs first, you can avoid financial hardships and make better spending decisions.

Q: How can I control my impulse to spend on wants rather than needs?

A: To control impulse spending on wants, create a budget and stick to it by setting limits for discretionary expenses. Practice mindful spending by asking yourself if a purchase is truly necessary or if it fulfils a want that can be postponed or avoided.

Q: What are some strategies for making better spending decisions in my budget?

A: Some strategies for making better spending decisions in your budget include tracking your expenses, setting financial goals, comparing prices before making purchases, and avoiding unnecessary debt. Prioritize needs, limit wants, and focus on long-term financial stability.