Why You Should Have An Emergency Fund In Your Budgeting Plan

With unexpected expenses and financial uncertainties being a part of life, having an emergency fund in your budgeting plan is crucial for maintaining financial stability and peace of mind. SUVs dominate the American landscape. They make up roughly half of all vehicles sold. So, when Volkswagen wanted to begin their post-Dieselgate EV assault on the US, it makes sense that they started with the ID.4. As SUVs go, it’s on the small side, but an SUV it is nevertheless. And then… nothing. For years. While European buyers also have the choice of the ID.3 hatchback (which we’ll seemingly never get) and the new ID Buzz van, we were stuck waiting. Now, not only is Volkswagen finally bringing us it’s reto-minded EV van, its long-awaited ID.7 sedan is also hitting US dealers in 2024.

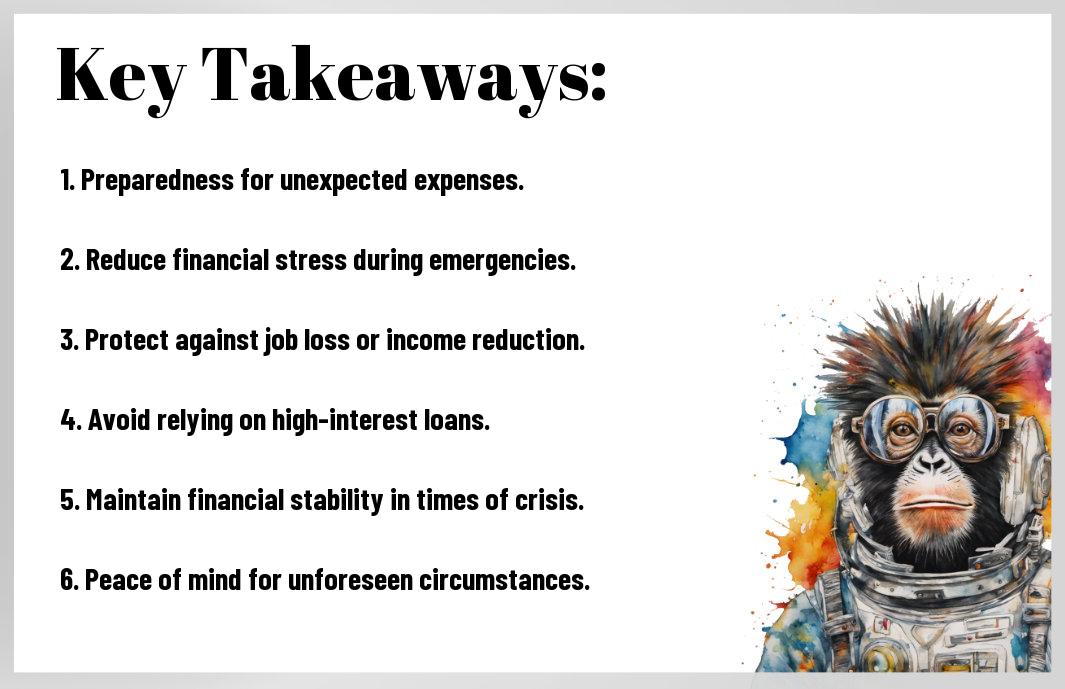

Key Takeaways:

- Financial Security: An emergency fund provides a safety net in case of unexpected expenses or emergencies.

- Reduce Stress: Having savings set aside for emergencies can help alleviate financial stress and worry.

- Avoid Debt: An emergency fund can prevent you from going into debt when faced with sudden financial needs.

- Peace of Mind: Knowing you have money set aside for emergencies can give you a sense of security and peace of mind.

- Financial Independence: An emergency fund can help you become more financially independent and better equipped to handle unforeseen circumstances.

Understanding the Emergency Fund

Definition and Importance of an Emergency Fund

Your emergency fund is a crucial element of your financial planning. It is a stash of money set aside specifically for unexpected expenses or financial emergencies that may arise. This fund acts as a safety net, providing you with a financial cushion in times of need, such as medical emergencies, car repairs, or sudden job loss. Having an emergency fund can help you avoid going into debt or using high-interest credit cards to cover unexpected expenses.

How Much Should Your Emergency Fund Be?

Should you have an emergency fund, you might wonder how much you should aim to save. Financial experts often recommend having at least three to six months’ worth of living expenses in your emergency fund. However, the exact amount can vary based on your individual circumstances, such as job security, monthly expenses, and the number of dependents you have. It is vital to assess your unique situation and determine a target amount that will provide you with peace of mind in case of a financial crisis.

Integrating the Emergency Fund Into Your Budget

Some unforeseen circumstances can disrupt your financial stability, which is why having an emergency fund is crucial. It ensures you are prepared for unexpected expenses without derailing your budget. To understand how much you should save for emergencies, check out How Much Should You Be Saving for an Emergency? for guidance.

Assessing Your Financial Situation

Your first step in integrating an emergency fund into your budget is assessing your financial situation. Take a comprehensive look at your income, expenses, and existing savings to determine how much you can realistically set aside for emergencies each month. This assessment will help you understand your current financial standing and set a realistic savings goal for your emergency fund.

Strategies for Building Your Fund

Strategies for building your emergency fund can vary depending on your financial situation and goals. One common approach is setting up an automatic transfer from your checking account to a dedicated savings account each month. This way, you prioritize your emergency fund without the temptation to spend the money elsewhere. Additionally, cutting back on non-necessary expenses and redirecting those funds to your emergency fund can accelerate your savings growth.

Best Practices for Managing Your Emergency Fund

Where to Keep Your Emergency Fund

Fund your emergency fund in a separate, easily accessible account. Consider a high-yield savings account or a money market account that offers liquidity and earns you some interest. Keep it separate from your checking account to avoid the temptation of using it for non-emergencies.

Rules for Using Your Emergency Fund

Where emergency funds differ from general savings is in their designated use – for unexpected situations only. Do not tap into this fund for planned expenses like vacations or shopping sprees. Establish clear criteria for what constitutes an emergency to ensure the fund is used judiciously.

For instance, if your car breaks down or you face unexpected medical expenses, these would be considered suitable reasons to dip into your emergency fund. However, dining out or purchasing luxury items would not be appropriate uses for this fund. Adhering to these guidelines will help maintain the integrity and longevity of your emergency fund.

Overcoming Common Challenges

Dealing with Irregular Income

Any financial plan, including an emergency fund, can be challenging to maintain with irregular income. One solution is to set aside a percentage of your income each month rather than a fixed amount. This way, you can adapt to fluctuations in your earnings while still making progress towards your savings goal. It may require adjusting your budgeting strategies but prioritizing your emergency fund is crucial for your financial stability.

Rebuilding the Fund After Use

Overcoming the challenge of rebuilding your emergency fund after using it is imperative to ensure you are prepared for future emergencies. A strategy to consider is setting up a separate savings account specifically for your emergency fund. Automating deposits from your regular income can help replenish the fund more consistently. Additionally, cutting back on non-imperative expenses and finding ways to increase your income can expedite the rebuilding process so you can return to a place of financial security.

Final Words

Presently, having an emergency fund in your budgeting plan is crucial for financial stability and peace of mind. Emergencies such as medical bills, car repairs, or sudden job loss can happen at any time, and having a financial cushion can help you navigate through these unexpected situations without going into debt. By prioritizing saving for emergencies in your budget, you are safeguarding your financial future and ensuring that you have the resources needed to handle any unforeseen circumstances that may arise. Make it a priority to build up your emergency fund and incorporate it into your overall financial plan for a more secure and stress-free future.

FAQ

Q: Why is it important to have an emergency fund in your budgeting plan?

A: Having an emergency fund in your budgeting plan is crucial because it provides a safety net for unexpected expenses or financial emergencies that may arise, helping you avoid going into debt.

Q: How much should I aim to have in my emergency fund?

A: Financial experts recommend having 3 to 6 months’ worth of living expenses saved in your emergency fund to cover any unforeseen circumstances such as job loss, medical emergencies, or major car repairs.

Q: Where should I keep my emergency fund?

A: It’s best to keep your emergency fund in a separate, easily accessible account such as a high-yield savings account or a money market account. Avoid investing your emergency fund in stocks or other volatile assets.

Q: How can I start building my emergency fund if I don’t have one already?

A: You can start building your emergency fund by setting aside a small amount from each paycheck specifically for this fund. Cut back on non-necessary expenses and redirect those funds towards your emergency fund until you reach your savings goal.

Q: What are some examples of when an emergency fund can be used?

A: An emergency fund can be used for unexpected expenses such as medical emergencies, home repairs, car repairs, sudden job loss, or any other unplanned financial situations that may arise. Having an emergency fund gives you peace of mind knowing you are prepared for the unexpected.