It’s imperative to understand the transformative role that artificial intelligence can play in your trading strategies. In this blog post, you will discover how to leverage AI tools and algorithms to analyze market trends, predict price movements, and optimize your decision-making process. By integrating these powerful insights into your trading routine, you’ll not only enhance performance but also gain a competitive edge in the ever-changing financial landscape. Get ready to revolutionize the way you trade by harnessing the full potential of AI technology.

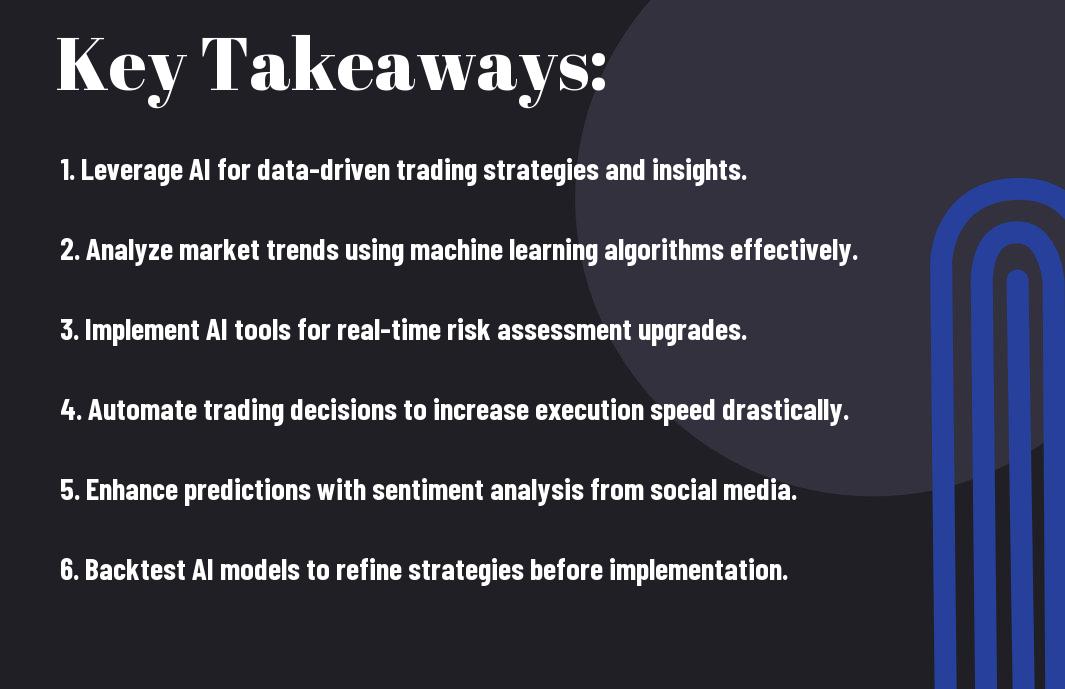

Key Takeaways:

- Data Analysis: AI can process vast amounts of historical and real-time data efficiently, enhancing the ability to identify patterns and trends that can inform trading decisions.

- Algorithmic Trading: Utilizing AI algorithms enables the execution of trades at optimal times, potentially maximizing profits and minimizing risks in volatile markets.

- Sentiment Analysis: AI tools can analyze news articles, social media, and other online content to gauge market sentiment, allowing traders to make informed predictions about price movements.

- Risk Management: AI can aid in developing sophisticated risk management strategies by assessing and predicting potential market downturns, helping to protect investments.

- Automation: Integrating AI into trading systems can automate routine tasks, freeing up traders to focus on strategy development and market analysis.

Understanding AI in Trading

Before exploring into the specifics, it’s imperative to understand how AI is revolutionizing trading. Artificial intelligence empowers traders with advanced data analysis capabilities, enabling you to assess market trends, predict price movements, and optimize your trading strategies. Leveraging AI can enhance your decision-making process, reduce human error, and ultimately improve your trading performance.

The Role of Machine Learning

Machine learning continuously adapts to new data inputs, allowing you to identify patterns in historical trading performance. This capability helps refine your approach to risk management and facilitates the development of predictive models that increase your chances of success in dynamic markets.

AI Algorithms and Their Applications

After understanding the foundation of AI in trading, you should explore the various algorithms driving this innovation. These algorithms can analyze vast amounts of data at lightning speed, helping you make more informed trading decisions.

Role of AI algorithms includes applications such as sentiment analysis, which gauges market mood, and algorithmic trading strategies tailored to real-time data. These algorithms also assist in portfolio management, enhancing asset allocation and minimizing risks. By utilizing these technologies, you can streamline your trading processes and gain a substantial edge in the competitive trading landscape.

Advantages of Using AI in Trading

It is vital to recognize the numerous advantages AI brings to trading activities. By harnessing advanced algorithms and data analytics, you can achieve improved efficiency, risk management, and predictive capabilities. AI tools help you make sense of vast amounts of market data, allowing you to uncover trends and patterns that human traders may overlook. Consequently, you can make more informed and timely trading decisions, ultimately enhancing your overall trading performance.

Enhanced Decision Making

On utilizing AI in your trading strategy, you enhance your decision-making process significantly. AI systems can analyze historical data, identify trends, and generate forecasts at impressive speeds. This allows you to assess various trading scenarios and evaluate potential outcomes before you execute a trade. With access to these insights, your trading decisions become more data-driven and objective rather than relying solely on intuition.

Real-Time Market Analysis

About real-time market analysis, AI empowers you to monitor market conditions instantaneously. Through continuous data collection and analysis, AI algorithms can detect shifts in market sentiment and price movements, giving you a competitive edge. This capability ensures that you are always informed of market fluctuations, enabling you to capitalize on opportunities or mitigate risks promptly.

In addition, leveraging AI for real-time market analysis helps you stay ahead of potential market changes. AI algorithms can process vast quantities of data from multiple sources, including social media, news articles, and trading volumes, allowing you to gauge market sentiment more accurately. By having a comprehensive understanding of rapid market dynamics, you can make proactive and precise trading decisions, maximizing your chances of success in the ever-changing financial landscape.

Implementing AI Strategies

Not every AI approach is effective for all traders. To maximize your trading performance, you should explore How To Use AI To Make Money With Investing. By carefully implementing AI strategies tailored to your unique trading style, you can harness the strengths of artificial intelligence to improve your decision-making and efficiency in the market.

Choosing the Right AI Tools

Choosing the right AI tools is important for enhancing your trading performance. Consider factors like user-friendliness, functionality, and the specific algorithms that align with your trading goals. Research various platforms and software options before making a decision, ensuring they meet your criteria for data analysis, forecasting, and automation.

Developing a Customized Trading Plan

One of the most effective ways to utilize AI in your trading is by developing a customized trading plan. A tailored plan allows you to incorporate AI insights while considering your risk tolerance and investment goals.

Developing a customized trading plan involves analyzing your trading history, understanding market conditions, and defining clear entry and exit strategies. By integrating AI-driven predictions, you can refine your approach to adapt to market changes and enhance your overall performance. Regularly revisiting and adjusting your plan will ensure your strategy is always aligned with evolving market dynamics.

Risk Management with AI

Keep in mind that integrating AI into your trading strategy can significantly enhance your risk management processes. By leveraging advanced technologies, you can better predict market volatility, making informed decisions that protect your capital. AI can analyze vast amounts of data to identify potential risks, giving you a clearer picture of your trading landscape and allowing you to optimize your strategies accordingly.

Predictive Analytics for Risk Assessment

Across various trading scenarios, predictive analytics can be a game changer for risk assessment. By utilizing machine learning algorithms, you can analyze historical data and recognize patterns that indicate potential downturns or market shifts. This foresight enables you to adjust your positions proactively, minimizing the chances of unpredictable losses and enhancing your overall trading performance.

Automated Trading With Built-In Safeguards

Assessment of your trading performance can be further improved through automated trading systems equipped with built-in safeguards. These systems allow you to set predefined criteria for entry and exit points, alongside risk thresholds that automatically execute trades based on your specifications.

Hence, employing automated trading with these built-in safeguards means you can effectively limit your exposure to risk. You’ll set parameters that trigger alerts or automatic sell-offs based on your risk appetite, ensuring that emotions do not cloud your judgment during volatility. By doing so, you are empowering yourself to maintain control over your trades, significantly reducing the likelihood of large, unexpected losses while maximizing the potential for consistent profits.

Case Studies: Successful AI Integration in Trading

Your journey into AI-enhanced trading is best informed by real-world success stories. Here are some notable case studies highlighting successful AI applications:

- Goldman Sachs: Leveraging AI algorithms, the investment bank improved trading execution speed by 20% and reduced market impact, resulting in significant cost savings.

- Bridgewater Associates: Implemented AI-driven systems to analyze historical trading data, which led to a 6% increase in portfolio performance over three years.

- Citadel Securities: Utilized machine learning to optimize market making, achieving a 40% improvement in trade response time.

- Two Sigma: Employed AI to analyze vast data sets, reaching an annual return exceeding 15% over the past five years.

Industry Leaders Using AI

Using AI technology, industry leaders are transforming trading strategies and decision-making processes. Firms like JPMorgan and BlackRock have successfully integrated AI systems to enhance their trading efficiency and predict market trends, allowing them to stay ahead of competition and maximize profitability.

Lessons Learned from AI-Driven Strategies

Strategies adopted from AI-driven models reveal the importance of data quality and continual system refinement. Traders have learned that consistently updating algorithms and incorporating diverse data types lead to more accurate predictions and better trading outcomes.

Case studies illustrate that successful AI implementations come from a deep understanding of trading patterns and market behaviors. Firms that continuously evolve their AI strategies and data inputs achieve sharper insights, as they are better equipped to navigate fluctuations in financial markets, leading to improved risk management and enhanced profitability in their trading operations.

Future Trends in AI and Trading

Now, as AI continues to evolve, you can expect transformative trends in trading dynamics. Machine learning algorithms and advanced data analytics will drive enhanced predictive capabilities, enabling traders like you to make more informed decisions. Explore more on AI-Enhanced Trading Strategies: Navigating the Financial … and discover how to leverage these innovations.

Advancements in AI Technology

Beside the emergence of sophisticated trading algorithms, advancements in natural language processing will also enhance your ability to analyze market sentiment. These technologies can interpret vast amounts of unstructured data, allowing you to gauge market trends with unprecedented accuracy.

The Evolving Landscape of Financial Markets

About the changes in financial markets, you should be mindful of the increasing integration of technology and finance. Trading platforms are becoming more automated, fostering an environment where AI can offer real-time insights, ultimately reshaping your trading strategies.

The evolution of financial markets means that you need to adapt continually. With increased digital assets and decentralized finance (DeFi) options emerging, the landscape is broadening. This shift provides unique opportunities for you to explore diverse investment avenues while AI tools enhance your decision-making process, keeping you ahead in a competitive environment.

To wrap up

Following this, you now have a solid understanding of how to harness AI to enhance your trading performance. By integrating advanced algorithms and data analysis into your trading strategies, you can gain deeper insights into market trends and make more informed decisions. Leveraging AI tools allows you to optimize your portfolio and potentially minimize risks. As you embrace these technologies, you’ll position yourself to navigate the complexities of the financial markets with greater confidence and efficiency.

FAQ

Q: What is ‘Powerful Insights’ and how does it relate to AI in trading?

A: ‘Powerful Insights’ is a comprehensive guide focused on leveraging artificial intelligence to optimize trading performance. It covers various AI techniques and tools that traders can employ to analyze market data, predict trends, and make informed decisions, ultimately enhancing their trading strategies.

Q: How can AI improve trading performance?

A: AI can enhance trading performance by analyzing vast amounts of data at high speeds, identifying patterns and trends that may not be visible to human traders. This includes predictive analytics, algorithmic trading, and sentiment analysis, which together can provide traders with actionable insights and help mitigate risks associated with market fluctuations.

Q: What techniques does the guide recommend for using AI in trading?

A: The guide suggests various techniques including machine learning models for predictive analysis, natural language processing for sentiment analysis, and automated trading systems to execute trades based on predefined criteria. These techniques help traders make data-driven decisions, improving accuracy and efficiency in their trades.

Q: Are there specific AI tools mentioned in the guide that traders should consider?

A: Yes, the guide highlights several AI tools that traders can utilize, such as trading bots, machine learning platforms, and data visualization software. Tools like TensorFlow for model building, or TradingView for strategy backtesting, are discussed, providing traders with options to enhance their trading operations through technology.

Q: Is prior knowledge of AI necessary to implement these strategies in trading?

A: While prior knowledge of AI and machine learning can be beneficial, the guide is designed to be accessible for traders at various skill levels. It provides step-by-step instructions and resources for beginners to get started with AI in trading, along with advanced techniques for those with more experience in the field.