With the rapid advancements in technology, quantum computing is poised to revolutionize various industries, including finance. The potential of quantum computers to analyze vast amounts of data and perform complex calculations at incredible speeds could significantly impact risk management in the financial sector. To probe deeper into this topic, explore The Impact of Quantum Computers on the Finance Sector for a comprehensive understanding of how quantum computing may transform risk management practices in financial institutions.

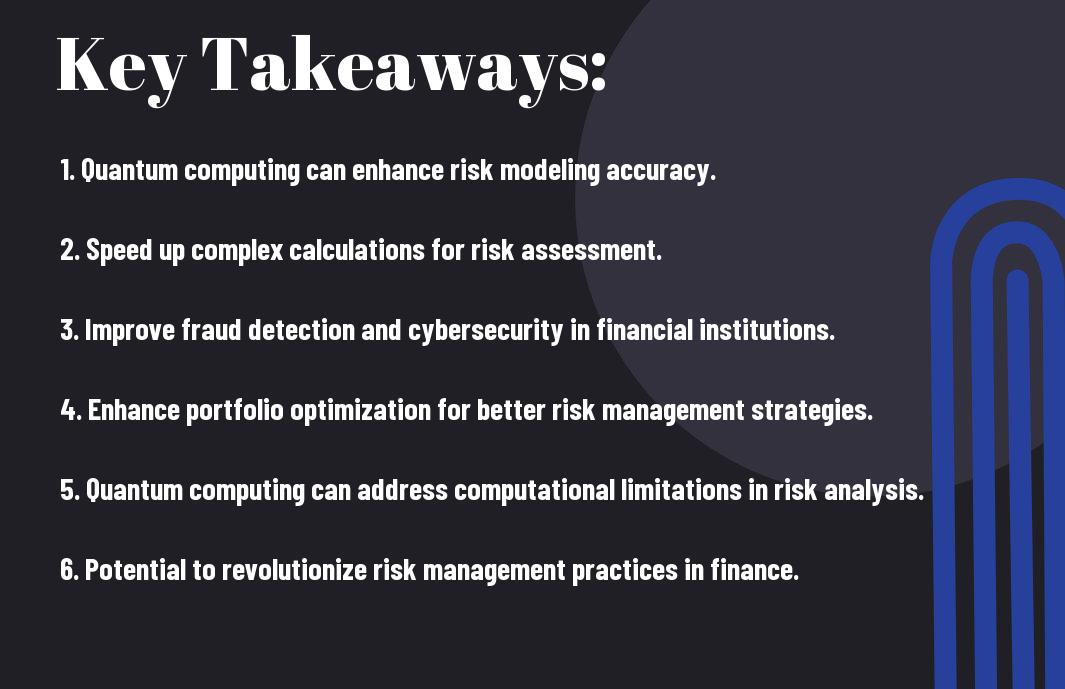

Key Takeaways:

- Quantum computing has the potential to revolutionize risk management in the financial sector by offering faster computations and the ability to handle complex probabilistic models.

- Quantum computing can enhance risk assessment by performing faster scenario analysis, stress testing, and portfolio optimization compared to classical computing methods.

- The implementation of Quantum computing in risk management can lead to more accurate predictions of financial risks and better decision-making processes for financial institutions.

- Quantum algorithms like Quantum Monte Carlo can enable more efficient simulations of risk factors, providing insights into market uncertainties and potential risks.

- Despite the potential benefits, the integration of Quantum computing in risk management requires overcoming challenges such as quantum error correction, scalability, and data privacy concerns.

- Financial institutions need to invest in research and development to understand how Quantum computing can be applied effectively to manage risks and gain a competitive advantage in the market.

- Collaboration between Quantum computing experts and risk management professionals is crucial to develop innovative solutions that can address the specific needs and challenges of the financial sector.

Fundamentals of Quantum Computing for Finance

Quantum Computing vs. Classical Computing

Even though classical computers have been the backbone of financial risk management for decades, quantum computing represents a paradigm shift in computational power. Quantum computing harnesses the principles of quantum mechanics, allowing for the processing of vast amounts of data simultaneously and performing calculations at speeds significantly faster than classical computers.

Key Quantum Algorithms Relevant to Finance

For financial institutions, understanding key quantum algorithms is crucial for leveraging the power of quantum computing in risk management. Quantum algorithms such as Grover’s algorithm, Shor’s algorithm, and Quantum Monte Carlo methods have the potential to revolutionize risk analysis, portfolio optimization, and fraud detection in the financial sector.

Fundamentals of Quantum Computing for Finance are rooted in the ability of quantum algorithms to solve complex problems more efficiently than classical algorithms. Grover’s algorithm, for example, can search unsorted databases quadratically faster than classical algorithms, while Shor’s algorithm has the potential to break traditional encryption methods like RSA. Quantum Monte Carlo methods provide a powerful tool for simulating complex quantum systems, offering efficient solutions for pricing derivatives and analyzing risk in financial portfolios.

Quantum Computing in Risk Management

Enhanced Computational Capabilities

The advent of quantum computing offers unparalleled computational power that can revolutionize risk management in the financial sector. With the ability to process vast amounts of data and perform complex calculations at speeds unimaginable with classical computers, quantum computing can enhance risk modeling and analysis, providing more accurate predictions and insights.

Real-Time Risk Analysis and Decision-Making

On the frontier of risk management lies the potential for real-time analysis and decision-making through quantum computing. By harnessing the principles of quantum mechanics, financial institutions can evaluate risks dynamically as they unfold, enabling proactive measures to be taken swiftly. This capability can significantly reduce exposure to potential threats and optimize decision-making processes in high-stakes scenarios.

Risk management practices in the financial sector are poised for transformation with the integration of quantum computing. Enhanced computational capabilities and real-time risk analysis and decision-making can elevate the industry to new heights, ensuring greater efficiency, accuracy, and resilience in the face of evolving risks.

Implications and Ethical Considerations

Data Security and Privacy

For organizations in the financial sector, the adoption of quantum computing brings both opportunities and challenges in terms of data security and privacy. An organization must ensure that sensitive financial data is protected from quantum threats, which have the potential to break traditional encryption methods. This necessitates the development of quantum-resistant encryption techniques and robust cybersecurity measures to safeguard customer information.

Regulatory and Ethical Implications

For the financial sector, the integration of quantum computing raises significant regulatory and ethical considerations. It is vital for regulators to keep pace with advancements in quantum technology to establish guidelines that mitigate risks and ensure fairness in the use of quantum algorithms for financial decision-making. Moreover, ethical considerations must be addressed, including transparency in algorithmic decision-making processes and accountability for any biases that may arise.

To navigate these complex regulatory and ethical landscapes, organizations in the financial sector must collaborate closely with policymakers, regulators, and ethicists to establish frameworks that promote responsible and ethical use of quantum computing in risk management practices.

Preparation for the Quantum Future

Investing in Quantum Research and Development

Quantum computing holds the potential to revolutionize risk management in the financial sector. To prepare for this quantum future, organizations must invest in quantum research and development. By allocating resources towards exploring quantum computing capabilities, financial institutions can stay ahead of the curve and leverage the power of quantum algorithms for risk assessment and management.

Building a Quant-based Workforce

Quantum-based workforce is crucial for navigating the complexities of quantum computing in risk management. By training employees in quantitative finance and data analysis, organizations can build a workforce equipped to harness the possibilities of quantum computing. This workforce will be important in implementing and interpreting quantum algorithms to optimize risk strategies and improve decision-making processes.

Investing in the development of a quant-based workforce involves not only providing training in quantum computing principles but also fostering a culture of innovation and continuous learning within the organization. By attracting top talent in the field of quantum finance and nurturing their skills, financial institutions can cultivate a competitive edge in the quantum future.

Final Words

Summing up, quantum computing has the potential to revolutionize risk management in the financial sector by offering unparalleled processing power to analyze complex data and simulations. While the technology is still in its early stages, the advancements being made are promising, and as quantum computing continues to evolve, it may completely transform how financial institutions assess and mitigate risks in the future. By embracing the potential of quantum computing, financial organizations can stay ahead of competitors and adapt to the rapidly changing landscape of risk management. It is important for financial institutions to stay informed and explore the possibilities that quantum computing can offer in enhancing risk management strategies to ensure stability and success in the dynamic financial markets.

FAQ

Q: What is quantum computing?

A: Quantum computing is a cutting-edge computing technology that utilizes the principles of quantum mechanics to perform operations on data in a fundamentally different way than classical computing.

Q: How can quantum computing transform risk management in the financial sector?

A: Quantum computing has the potential to revolutionize risk management in the financial sector by enabling more complex calculations and simulations, enhancing data security through quantum encryption, and optimizing portfolio management strategies.

Q: What are the key benefits of using quantum computing in risk management for financial institutions?

A: Some key benefits include improved risk assessment accuracy, faster analysis of vast amounts of data, enhanced cybersecurity measures, and the ability to create more robust financial models for decision-making.

Q: Are there any challenges in implementing quantum computing for risk management in the financial sector?

A: Yes, challenges include the high cost of quantum computing infrastructure, the need for specialized talent to operate quantum systems, and the current limitations in the scalability of quantum algorithms for financial applications.

Q: How can financial institutions prepare for the integration of quantum computing into their risk management practices?

A: Financial institutions can start by educating their teams on quantum computing, exploring collaborations with quantum technology providers, conducting pilot projects to test quantum applications, and developing a roadmap for gradual integration of quantum solutions into their risk management processes.