Is Your Budget Still Working For You? Tips For Regularly Reviewing And Adjusting

You work hard to create a budget that fits your financial goals and lifestyle, but have you ever stopped to consider if it’s still working for you? Regularly reviewing and adjusting your budget is crucial to ensure that you are on track to meet your financial objectives. Just like a car needs regular maintenance to keep running smoothly, your budget requires periodic check-ups and adjustments to remain effective. In this blog post, we will explore some tips to help you evaluate and optimize your budget to ensure that it continues to work for you. Stay tuned for practical advice on managing your finances and making the most of your hard-earned money.

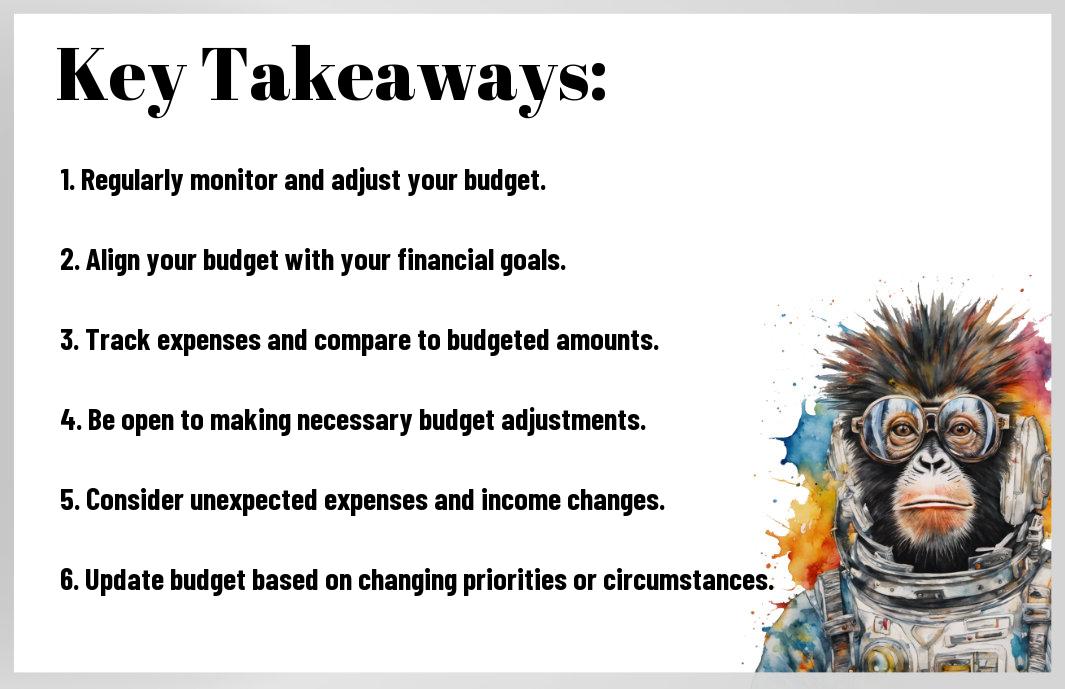

Key Takeaways:

- Regularly review your budget: It’s important to regularly review your budget to ensure it is still aligned with your financial goals and needs.

- Track your spending: Keep track of your spending habits to identify any areas where you may be overspending or where you can cut back.

- Make adjustments as needed: Be flexible with your budget and make adjustments as needed to accommodate any changes in your income or expenses.

- Revisit your goals: Regularly revisit your financial goals and update your budget to reflect any changes in your priorities or objectives.

- Seek professional help if needed: If you find it difficult to manage your budget on your own, consider seeking the help of a financial advisor or counselor to assist you in creating a budget that works for you.

Periodic Budget Review Strategies

Setting Regular Review Dates

There’s no better way to ensure your budget is still serving its purpose than by setting regular review dates. By scheduling a quarterly or bi-annual check-in, you can stay on top of any changes in your financial situation and adjust your budget accordingly. Mark these dates on your calendar and treat them as non-negotiable appointments to keep your finances in check.

Key Indicators for Budget Evaluation

Any successful budget review involves a thorough evaluation of key indicators to determine its effectiveness. Look at your spending habits, savings rate, debt levels, and overall financial goals. Are you sticking to your budget categories? Are you making progress towards your savings targets? Analyzing these key indicators will help you identify areas for improvement and make necessary adjustments to your budget.

Plus, consider using tools like budgeting apps or spreadsheets to track these indicators automatically and provide you with detailed reports on your financial health. This can simplify the review process and give you a more comprehensive understanding of your budget’s performance.

Adjusting Your Budget to Current Goals

Aligning Budget with Changing Priorities

The key to ensuring your budget is still working for you is to regularly align it with your current priorities. As life evolves, so do our goals and aspirations. Take the time to assess what matters most to you now and adjust your finances accordingly. This may involve reallocating funds from less important areas to those that align with your new priorities.

Adapting to Financial Windfalls and Setbacks

Any unexpected financial changes, whether positive or negative, can have a significant impact on your budget. It’s crucial to adapt to these windfalls and setbacks appropriately. If you receive a bonus or inheritance, consider using it to pay off debt, boost savings, or invest in your long-term goals. On the flip side, if you encounter a financial setback such as a medical emergency or job loss, reassess your budget and make necessary adjustments to cover vital expenses and manage any new debts.

When adapting to financial windfalls, it’s important to stay disciplined and avoid splurging on unnecessary expenses. Similarly, in times of setbacks, prioritize your spending to meet your immediate needs and preserve your financial stability. By having a flexible budget that can accommodate both positive and negative financial changes, you can stay on track towards achieving your long-term financial objectives.

Tools and Techniques for Budget Management

Budgeting Software and Apps

Many individuals and families find that using budgeting software and apps can greatly simplify the process of managing their finances. These tools offer features such as automatic tracking of expenses, customizable budget categories, and visual representations of spending patterns. Popular options include Mint, YNAB (You Need a Budget), and EveryDollar. By utilizing these tools, you can gain better insight into your financial habits and make more informed decisions about where to cut back or allocate more funds.

The Envelope System and Zero-Based Budgeting

On the other hand, some people prefer more tangible methods of budgeting such as the envelope system and zero-based budgeting. With the envelope system, you allocate cash into envelopes designated for different spending categories, ensuring that you only spend what you have budgeted for each category. Zero-based budgeting, on the other hand, involves giving every dollar a specific purpose, whether it’s for expenses, savings, or debt repayment. This method can help ensure that you are maximizing the use of your income and not letting any money go to waste.

Zero-based budgeting involves assigning every dollar a purpose, whether it’s for expenses, savings, or debt repayment. This method can help you take control of your finances and ensure that you are maximizing the use of your income. By giving each dollar a job, you can avoid overspending and make sure that every aspect of your financial life is accounted for.

Overcoming Common Budgeting Challenges

Dealing with Irregular Income

On occasion, individuals may face the challenge of irregular income, making it difficult to predict how much money will be coming in each month. One way to tackle this challenge is by setting aside a portion of your income during the months when you earn more than usual, in order to cover expenses during the months when your income is lower. Creating a buffer fund can help stabilize your finances and provide a safety net during uncertain times.

Planning for Unforeseen Expenses

With the unpredictability of life, unexpected expenses can arise at any moment, throwing off your budget. To mitigate the impact of these unforeseen costs, it is imperative to proactively plan for them by setting aside a portion of your income each month into an emergency fund. Having an emergency fund can provide you with peace of mind knowing that you have a financial cushion to fall back on in times of need.

Plus, consider reviewing your budget regularly and making adjustments to allocate more funds towards your emergency fund to build it up over time. By having a solid emergency fund in place, you can better withstand unexpected financial challenges and stay on track with your overall financial goals.

Final Words

Presently, it is crucial to regularly review and adjust your budget to ensure it is still serving your financial needs effectively. By implementing the tips provided in this article, such as tracking your expenses, setting realistic goals, and reassessing your priorities, you can ensure that your budget remains a useful tool in managing your finances. Bear in mind, that financial circumstances can change rapidly, so taking the time to review and adjust your budget regularly will help you stay on track towards achieving your financial goals.

FAQ

Q: Why is it important to regularly review and adjust your budget?

A: It is important to regularly review and adjust your budget to ensure that it still aligns with your financial goals, helps you track expenses, and allows for any necessary changes in your income or spending habits.

Q: How often should I review my budget?

A: It is recommended to review your budget at least once a month to stay on top of your finances and make any adjustments as needed.

Q: What are some signs that my budget may not be working for me anymore?

A: Some signs that your budget may not be working for you include regularly overspending, not meeting savings goals, or feeling stressed about money. These are indicators that it may be time to review and adjust your budget.

Q: What are some tips for effectively reviewing and adjusting my budget?

A: Some tips for effectively reviewing and adjusting your budget include tracking your expenses, comparing them to your budgeted amounts, identifying areas where you can cut back or save more, and being flexible to adapt to any changes in your financial situation.

Q: Can I seek help from a financial advisor to review and adjust my budget?

A: Yes, you can seek help from a financial advisor to review and adjust your budget. A professional can provide personalized guidance, help you set realistic financial goals, and create a budget that works best for your individual needs and circumstances.

I was examining some of your articles on this website and I think this site is really

instructive! Keep putting up.Blog range