Processing natural language in the finance sector can significantly enhance customer service experiences. Natural Language Processing (NLP) technologies can revolutionize how financial institutions interact with clients, providing swift responses and accurate assistance. By leveraging NLP tools, banks and financial firms can streamline communication channels, personalize customer interactions, and gain deeper insights into client needs. Learn more about the potential impact of NLP in financial services in this informative article on 5 Ways to Use Natural Language Processing in Financial ….

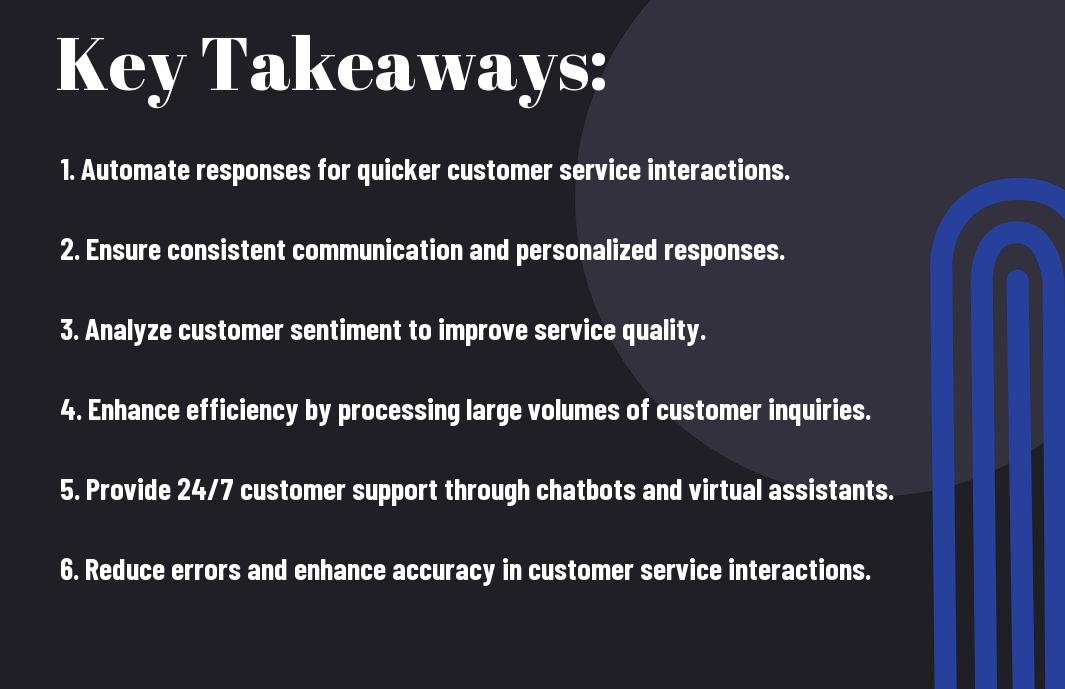

Key Takeaways:

- Enhanced Customer Interactions: Natural Language Processing (NLP) enables personalized and real-time responses to customer queries, enhancing the overall customer service experience.

- Efficient Query Resolution: NLP algorithms can analyze and understand customer queries in natural language, leading to faster and more accurate query resolutions.

- Data Analysis and Insights: NLP can process a vast amount of customer data to uncover trends, sentiments, and patterns, providing valuable insights for improving customer service strategies.

- Automated Processes: NLP-powered chatbots and virtual assistants can handle routine customer inquiries, allowing human agents to focus on more complex issues, thereby increasing efficiency.

- Compliance and Security: NLP can help financial institutions ensure compliance with regulations by analyzing customer interactions for any compliance breaches or security risks.

- 24/7 Support: NLP enables round-the-clock customer support, ensuring that customers can get assistance anytime, anywhere, leading to increased customer satisfaction.

- Scalability and Cost Savings: By automating aspects of customer service through NLP, financial institutions can scale their operations efficiently and reduce costs associated with manual customer support.

Understanding the Role of NLP in Finance

Key Features of NLP in Financial Services

While Natural Language Processing (NLP) plays a crucial role in enhancing customer service in finance, it is vital to understand the key features that make it indispensable in financial services:

- Sentiment Analysis to gauge customer emotions and reactions.

- Named Entity Recognition for identifying important entities like names, organizations, and locations.

- Relationship Extraction to understand connections between different entities.

- Summarization to condense large amounts of text into concise summaries.

Knowing these features can help financial service providers leverage NLP to improve customer interactions and streamline operations.

Benefits of NLP to Financial Service Providers

Any financial service provider looking to stay competitive in today’s market can benefit significantly from integrating NLP into their customer service operations. This technology enables providers to analyze customer feedback, automate responses, and personalize customer interactions.

This not only leads to enhanced customer satisfaction but also improves operational efficiency and helps in making data-driven decisions that ultimately drive business growth.

Implementation Strategies for NLP in Customer Service

Integrating NLP with Existing Customer Service Channels

Despite the challenges, integrating NLP with existing customer service channels can revolutionize the way financial institutions interact with their clients. By leveraging NLP technologies, organizations can automate responses to routine inquiries, provide personalized recommendations, and analyze customer sentiment in real-time. This ensures a seamless and efficient customer service experience while freeing up human agents to focus on more complex tasks.

Training NLP Systems with Financial Jargon and Customer Interactions

Customer service teams in the finance industry can enhance the effectiveness of NLP systems by training them with a mixture of financial jargon and real customer interactions. By exposing the systems to a variety of scenarios and language patterns specific to the industry, they can better understand and respond to customer queries accurately. This targeted training results in higher accuracy rates and improves overall customer satisfaction.

Interactions between customers and financial institutions often involve complex terminology and specific inquiries related to accounts, transactions, or financial products. By incorporating these nuances into the training data for NLP systems, organizations can ensure that the technology can effectively interpret and respond to customer needs with precision and speed.

Addressing Challenges and Limitations

Data Privacy and Security Concerns in Finance

With the increasing use of Natural Language Processing (NLP) in customer service in finance, data privacy and security concerns are paramount. Financial institutions must ensure that sensitive customer information is protected at all stages of interaction. Implementing robust encryption protocols, strict access controls, and regular security audits are vital to mitigate risks associated with handling confidential data.

Overcoming Technical Limitations and User Resistance

With the implementation of NLP in financial customer service, technical limitations such as language processing accuracy and user resistance to automated interactions are common challenges. By continuously refining NLP algorithms through machine learning and artificial intelligence, financial institutions can improve the accuracy and efficiency of language processing. Additionally, educating customers on the benefits of NLP in enhancing service quality and response time can help alleviate user resistance.

Overcoming technical limitations and user resistance requires a proactive approach from financial institutions. By investing in cutting-edge technology, training staff adequately, and providing transparent communication with customers, organizations can successfully integrate NLP into their customer service operations while addressing potential challenges effectively.

Case Applications & Future Trends

Examples of Successful NLP Use in Finance

All major financial institutions are rapidly adopting Natural Language Processing (NLP) technology to enhance customer service. An example of successful NLP use in finance is the implementation of chatbots to provide 24/7 customer support. These chatbots can understand and respond to customer queries in real-time, improving response times and overall customer satisfaction.

Predicting the Future of NLP in Financial Customer Service

Trends indicate that the future of NLP in financial customer service will focus on personalization and automation. NLP algorithms will be able to analyze customer data to offer personalized financial advice and tailored product recommendations. With advancements in machine learning, NLP systems will become increasingly autonomous, handling complex customer interactions with minimal human intervention.

Predicting the future of NLP in financial customer service also involves the integration of voice recognition technology. Customers will be able to interact with financial institutions using voice commands, making the customer experience more seamless and convenient. Additionally, sentiment analysis capabilities will be further developed to gauge customer emotions and provide more empathetic responses, enhancing overall customer satisfaction.

Conclusion

As a reminder, natural language processing can greatly enhance customer service in the finance industry by automating routine inquiries, providing instant support to customers, and analyzing vast amounts of data to identify trends and patterns. By implementing NLP technology, financial institutions can improve efficiency, reduce response times, and ultimately enhance the overall customer experience. It is clear that the integration of NLP tools in customer service operations can lead to significant benefits for both customers and financial institutions alike.

FAQ

Q: What is Natural Language Processing (NLP)?

A: Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on the interaction between computers and humans using natural language.

Q: How can Natural Language Processing improve customer service in finance?

A: NLP can improve customer service in finance by enabling quick and accurate responses to customer queries, automating processes, analyzing customer sentiment, and personalizing interactions.

Q: What are the benefits of using NLP in customer service for financial institutions?

A: Some benefits of using NLP in customer service for financial institutions include improved efficiency through automation, enhanced customer experiences, increased customer satisfaction, and better insights through data analysis.

Q: How does NLP help financial institutions in understanding customer sentiments?

A: NLP can help financial institutions in understanding customer sentiments by analyzing text data from customer interactions, social media, surveys, and reviews to identify trends, preferences, and concerns of customers.

Q: Are there any challenges in implementing NLP for customer service in finance?

A: Some challenges in implementing NLP for customer service in finance include data privacy concerns, the need for high-quality training data, the complexity of financial language, and the requirement for ongoing maintenance and updates to keep up with evolving customer needs.