Want To Achieve Your Financial Goals? Here’s How Budgeting Can Help

The key to achieving your financial goals lies in having a solid budgeting strategy in place. Just like how SUVs dominate the American vehicle market, budgeting plays a dominant role in helping you navigate your financial landscape. By starting with a clear budget, similar to Volkswagen’s ID.4 leading the post-Dieselgate EV assault on the US, you can pave the way towards financial success. As Volkswagen expanded its electric vehicle lineup to cater to various needs, including the ID Buzz van and the upcoming ID.7 sedan, effective budgeting allows you to customize your financial plan to achieve specific goals. In this blog post, we will explore the importance of budgeting and how it can be your ticket to financial freedom.

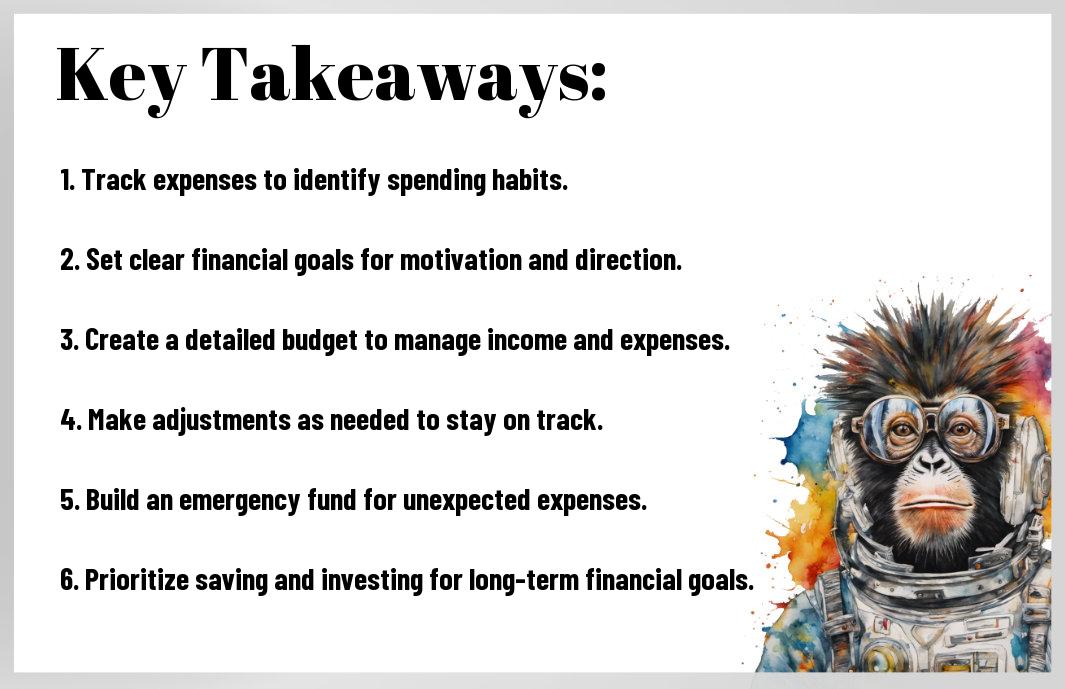

Key Takeaways:

- Budgeting is the foundation of financial success: Creating and sticking to a budget is key to achieving your financial goals.

- Helps track your spending: Budgeting allows you to see exactly where your money is going each month, helping you identify areas where you can cut back.

- Allows you to save and invest wisely: By budgeting, you can allocate funds for your savings and investments, ensuring you have money set aside for the future.

- Reduces financial stress: Knowing where your money is going and having a plan in place can help reduce financial stress and anxiety.

- Helps you prioritize your financial goals: With a budget in place, you can allocate funds towards your most important financial goals, such as paying off debt or saving for a big purchase.

Understanding Budgeting

Definition and Basic Principles

Principles of budgeting revolve around the concept of allocating your income towards various expenses, savings, and investments in a structured manner. The basic principles include creating a realistic budget based on your income, tracking your expenses, setting financial goals, and adjusting your budget as needed to stay on track.

Different Budgeting Methods

On the topic of different budgeting methods, there are several approaches you can take to manage your finances effectively. Some popular methods include the 50/30/20 rule, zero-based budgeting, envelope system, and spreadsheet budgeting. Each method has its own advantages and can be tailored to suit your individual financial goals and lifestyle.

Basic knowledge of these budgeting methods can help you choose the right one that aligns with your money management style and goals. It’s important to experiment with different methods to find the one that works best for you and helps you achieve your financial objectives.

Setting Your Financial Goals

After creating a budget, the next step towards achieving your financial goals is to set those goals. This involves identifying what you want to accomplish with your finances and setting specific targets to work towards.

Short-Term vs. Long-Term Goals

Goals can be categorized as short-term or long-term, depending on the time frame for achieving them. Short-term goals are typically achieved within a year, while long-term goals may take several years or even decades to accomplish. It is important to set a mix of both short-term and long-term goals to keep your financial plan balanced and well-rounded.

SMART Goals for Financial Planning

For effective financial planning, it is imperative to set SMART goals. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. This framework ensures that your goals are clearly defined, quantifiable, realistic, aligned with your objectives, and have a deadline for completion.

This approach helps you stay focused and motivated, as it provides a clear roadmap for your financial journey. By setting SMART goals, you increase the likelihood of success and can track your progress more effectively along the way.

Creating and Implementing Your Budget

Tracking Your Income and Expenses

All successful budgets start with tracking your income and expenses. This step is crucial in understanding where your money is coming from and where it is going. Begin by documenting all sources of income, including paychecks, bonuses, and other earnings. Next, keep track of your expenses by categorizing them into crucials like housing and utilities, and non-crucials such as entertainment and dining out. Use tools like spreadsheets or budgeting apps to help streamline this process and gain a clear picture of your financial flow.

Allocating Funds and Adjusting Habits

Your budgeting journey continues with allocating funds to different categories and adjusting spending habits accordingly. Determine how much you need to allocate towards crucials, savings, debt payments, and discretionary spending. Analyze your current habits and identify areas where you can cut back or make smarter choices. Consider setting specific financial goals, such as paying off debt or saving for a big purchase, to guide your allocations and ensure you stay on track.

With a well-defined budget in place, you can begin adjusting your habits to align with your financial goals. This may involve making sacrifices in certain areas to prioritize others or finding creative ways to save money. Regularly review your budget and make adjustments as needed to ensure you are staying on course towards achieving your financial objectives.

Overcoming Common Budgeting Challenges

Staying Motivated and Disciplined

With your financial goals in mind, staying motivated and disciplined is crucial to the success of your budgeting efforts. One effective way to stay on track is to regularly review your progress and remind yourself of the reasons why you set those goals in the first place. Setting both short-term and long-term financial goals can help keep you motivated and focused. Consider using techniques such as visualizing your goals, creating a vision board, or even enlisting an accountability partner to help you stay disciplined.

Dealing with Unexpected Expenses

For many individuals, unexpected expenses can often derail even the best budgeting intentions. This is why it is important to build an emergency fund as part of your budgeting strategy. Having a financial cushion to fall back on when unexpected expenses arise can help you stay on track with your budgeting goals. Consider setting aside a portion of your income each month specifically for your emergency fund, and only use it for true emergencies like medical bills, car repairs, or home maintenance.

This proactive approach to dealing with unexpected expenses can help alleviate financial stress and prevent you from dipping into other budget categories when the unexpected occurs.

Enhancing Your Budgeting with Financial Tools

Digital Budgeting Apps

The key to achieving your financial goals lies in effective budgeting, and digital budgeting apps can be a game-changer in this regard. These apps offer features that make budgeting easy and convenient, such as automatic expense tracking, goal setting, and customizable categories. Whether you’re at home or on the go, having your budget at your fingertips can help you stay on track and make informed financial decisions.

Utilizing Spreadsheets and Templates

Financial success doesn’t always require fancy tools – sometimes a simple spreadsheet or template can do the trick. By utilizing spreadsheets and templates, you have the flexibility to customize your budgeting method to suit your needs perfectly. Plus, the act of manually inputting your expenses can increase mindfulness and awareness of your spending habits, leading to better financial decisions in the long run.

Plus, with spreadsheets, you can easily visualize your financial data, track your progress, and make adjustments as needed, giving you a clearer picture of your financial health.

Conclusion

Presently, achieving your financial goals can seem like a daunting task, but with proper budgeting, it becomes more attainable. Budgeting allows you to track your expenses, identify areas where you can cut back, and plan for future financial milestones. By creating a budget and sticking to it, you can take control of your finances and make significant strides toward reaching your financial goals. So, if you want to achieve financial success, consider implementing a budgeting strategy to help you stay on track and make your goals a reality.

FAQ

Q: Why is budgeting important for achieving financial goals?

A: Budgeting is crucial for achieving financial goals because it helps you track your income and expenses, identify areas where you can cut back, and stay disciplined in your spending.

Q: How does budgeting help in managing debt?

A: Budgeting allows you to allocate a portion of your income towards paying off debts, helping you reduce debt faster and avoid falling into further financial trouble.

Q: Can budgeting help in building savings and investments?

A: Yes, budgeting plays a key role in building savings and investments by setting aside money for future goals, such as creating an emergency fund, saving for retirement, or investing in opportunities that can grow your wealth.

Q: What are the common challenges people face when budgeting?

A: Common challenges people face when budgeting include overspending, lack of discipline, unexpected expenses, and not having a clear understanding of their financial goals.

Q: How can someone start budgeting effectively?

A: To start budgeting effectively, begin by tracking your expenses, setting specific financial goals, creating a budget plan that aligns with your goals, monitoring your progress regularly, and making adjustments as needed to stay on track.