Most financial institutions are increasingly turning to AI-powered chatbots to streamline customer interactions and enhance services. These virtual assistants offer a range of benefits such as 24/7 customer support, personalized recommendations, efficient transaction processing, and improved fraud detection. To explore how AI chatbots are revolutionizing the financial sector, check out our blog post on Chatbots in Finance [Benefits, Examples, Future].

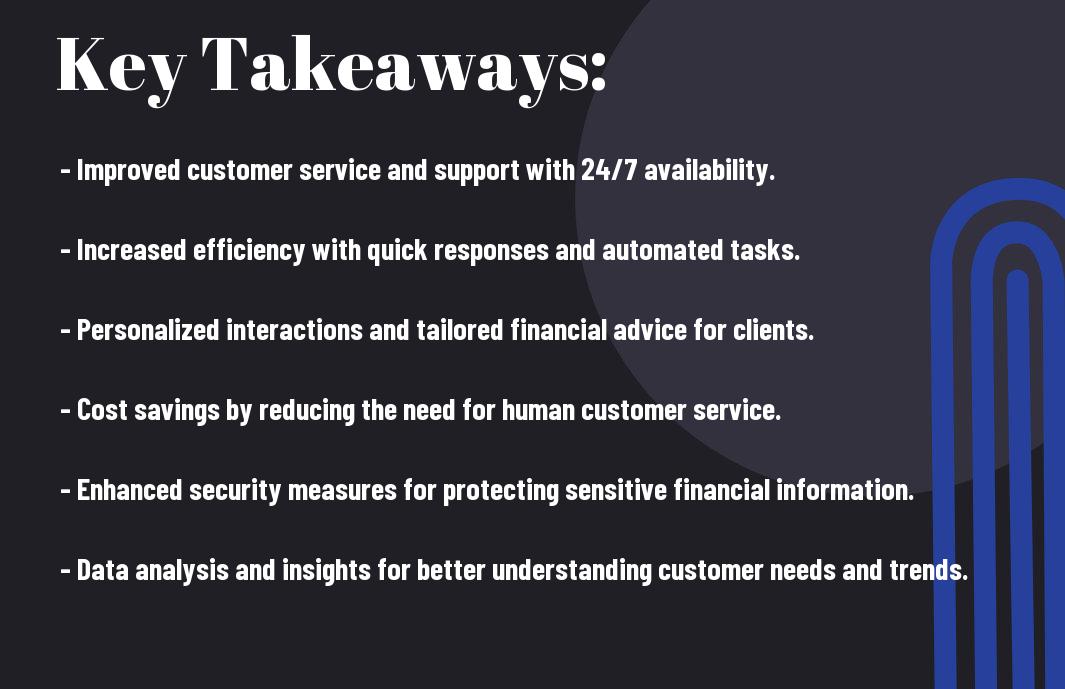

Key Takeaways:

- Enhanced Customer Service: AI-powered chatbots can efficiently handle customer queries 24/7, improving response time and customer satisfaction.

- Cost Reduction: Chatbots can automate routine tasks, reducing operational costs for financial institutions.

- Personalized Recommendations: AI algorithms can analyze customer data to provide tailored financial advice and product recommendations.

- Increased Efficiency: Chatbots can process a high volume of customer inquiries simultaneously, improving operational efficiency.

- Improved Security: AI-powered chatbots are equipped with advanced security features to handle sensitive financial data securely.

- Proactive Customer Engagement: Chatbots can engage with customers proactively, offering support and guidance in real-time.

- Data Analytics: Chatbots can collect and analyze customer interaction data to generate insights for better decision-making in financial services.

Enhancing Customer Experience

24/7 Customer Support

The adoption of AI-powered chatbots in financial services has revolutionized customer support by offering round-the-clock assistance. These chatbots are programmed to provide instant responses to customer queries and concerns, ensuring that customers receive support whenever they need it.

Personalized Financial Assistance

To further enhance the customer experience, AI-powered chatbots can provide personalized financial assistance tailored to individuals’ specific needs and preferences. By analyzing data and customer interactions, these chatbots can offer personalized recommendations and solutions, leading to a more engaging and satisfying customer experience.

For instance, a customer inquiring about investment options can receive personalized recommendations based on their risk tolerance, investment goals, and previous interactions with the chatbot. This level of personalized assistance not only streamlines the decision-making process for customers but also builds trust and loyalty towards the financial institution.

Operational Efficiencies

Automating Routine Tasks

Many financial institutions are turning to AI-powered chatbots to automate routine tasks such as account balance inquiries, transaction history requests, and payment processing. This automation not only saves time for customers but also frees up human agents to focus on more complex and high-value interactions.

Reducing Operational Costs

To enhance operational efficiencies, financial services firms are leveraging AI-powered chatbots to streamline processes and reduce costs. By automating repetitive tasks that would otherwise require human intervention, organizations can significantly decrease operational expenses.

Automating operational processes through chatbots can lead to cost savings in various areas such as customer service, back-office operations, and compliance. These bots can handle a high volume of inquiries simultaneously, reducing the need for large customer support teams and ultimately cutting down on operational expenses.

Compliance and Security

Ensuring Regulatory Compliance

One of the key benefits of using AI-powered chatbots in financial services is the ability to ensure regulatory compliance. These chatbots are equipped with built-in capabilities to stay up-to-date with the latest regulations and guidelines, reducing the risks of non-compliance and potential legal repercussions.

Advanced Security Measures

One of the key benefits of using AI-powered chatbots in financial services is the advanced security measures they offer. These chatbots are designed to handle sensitive financial information securely, utilizing encryption and authentication protocols to safeguard data from cyber threats.

- For Ensuring Regulatory Compliance:

1. Real-time monitoring of conversations for compliance violations 2. Automated logging and auditing capabilities for regulatory purposes

- For Advanced Security Measures:

1. End-to-end encryption of all communication channels 2. Multi-factor authentication for user identity verification

For instance, AI-powered chatbots in financial services can detect and prevent fraudulent activities in real-time, providing an additional layer of security for both the institution and its clients. By leveraging machine learning algorithms, these chatbots can identify suspicious patterns and behaviors to mitigate risks effectively.

Insights and Decision Making

Real-Time Data Analysis

Analysis of real-time data is a crucial aspect of financial services, allowing companies to monitor and understand market trends, customer behavior, and internal operations instantly. AI-powered chatbots can provide immediate insights by analyzing vast amounts of data in real-time, enabling financial institutions to make informed decisions swiftly.

Predictive Financial Services

On the other hand, predictive financial services utilize AI algorithms to forecast future trends and outcomes based on historical data and patterns. By leveraging machine learning capabilities, chatbots can offer personalized financial advice, predict market fluctuations, and even identify potential risks for clients, enhancing decision-making processes.

Financial organizations can benefit significantly from predictive analytics offered by AI-powered chatbots. These tools can help identify potential investment opportunities, detect fraud patterns, and optimize portfolio management strategies. By integrating predictive financial services into their operations, companies can stay ahead of the curve and provide more value to their clients.

Challenges and Considerations

Integration with Existing Systems

Systems within financial institutions are often complex and interconnected. Integrating AI-powered chatbots seamlessly into existing systems can be a challenging task. It requires careful planning, coordination, and sometimes significant restructuring to ensure smooth functionality without disrupting daily operations.

User Acceptance and Trust

To effectively leverage the benefits of AI-powered chatbots in financial services, user acceptance and trust are key factors to consider. Users may be hesitant to interact with chatbots for sensitive financial tasks or may not trust the accuracy of bot responses. Building trust and ensuring user acceptance through transparent communication, data security measures, and clear escalation paths are crucial for successful implementation.

Considerations: Financial institutions must prioritize user education and communication to increase user acceptance and trust in AI-powered chatbots. Implementing stringent data security measures, ensuring compliance with regulations, and offering clear channels for human support can help alleviate concerns and drive adoption of chatbot technology in the financial sector.

Summing up

So, the benefits of using AI-powered chatbots in financial services are numerous and impactful. From providing 24/7 customer support to improving efficiency and accuracy in transactions, these chatbots are revolutionizing the way financial institutions interact with their customers. By leveraging the power of artificial intelligence, financial services can enhance customer experience, increase operational efficiency, and ultimately drive revenue growth. In a rapidly evolving digital landscape, embracing AI chatbots could be the key to staying competitive and meeting the ever-changing needs of customers in the financial industry.

FAQ

Q: What are AI-powered chatbots in financial services?

A: AI-powered chatbots in financial services are virtual assistants that use artificial intelligence to interact with users, simulate conversations, and provide automated support for various financial tasks.

Q: What are the benefits of using AI-powered chatbots in financial services?

A: AI-powered chatbots in financial services offer 24/7 customer support, personalized recommendations, faster response times, cost efficiency, and enhanced user experience.

Q: How do AI-powered chatbots enhance customer support in financial services?

A: AI-powered chatbots provide instant responses to customer queries, handle a high volume of inquiries simultaneously, offer personalized assistance based on user data, and can escalate complex issues to human agents when needed.

Q: What role do AI-powered chatbots play in improving customer experience in financial services?

A: AI-powered chatbots enhance customer experience by providing quick and accurate responses, offering personalized recommendations, simplifying complex financial processes, and improving overall customer engagement and satisfaction.

Q: How do AI-powered chatbots contribute to cost savings in financial services?

A: AI-powered chatbots reduce the need for human customer support agents, decrease response times, handle repetitive tasks efficiently, and help financial institutions streamline their operations, leading to significant cost savings in the long run.