Automate Your Savings – The Key To Reaching Your Financial Goals Faster

You know the importance of saving for your financial future, but finding the discipline and consistency to do so can be challenging. That’s where automating your savings comes in. By setting up automatic transfers from your checking account to a savings account or investment account, you can ensure that you are consistently putting money aside without even thinking about it. This not only helps you reach your financial goals faster but also removes the temptation to spend the money instead. In this blog post, we will investigate the benefits of automating your savings and provide tips on how to set up a system that works for you.

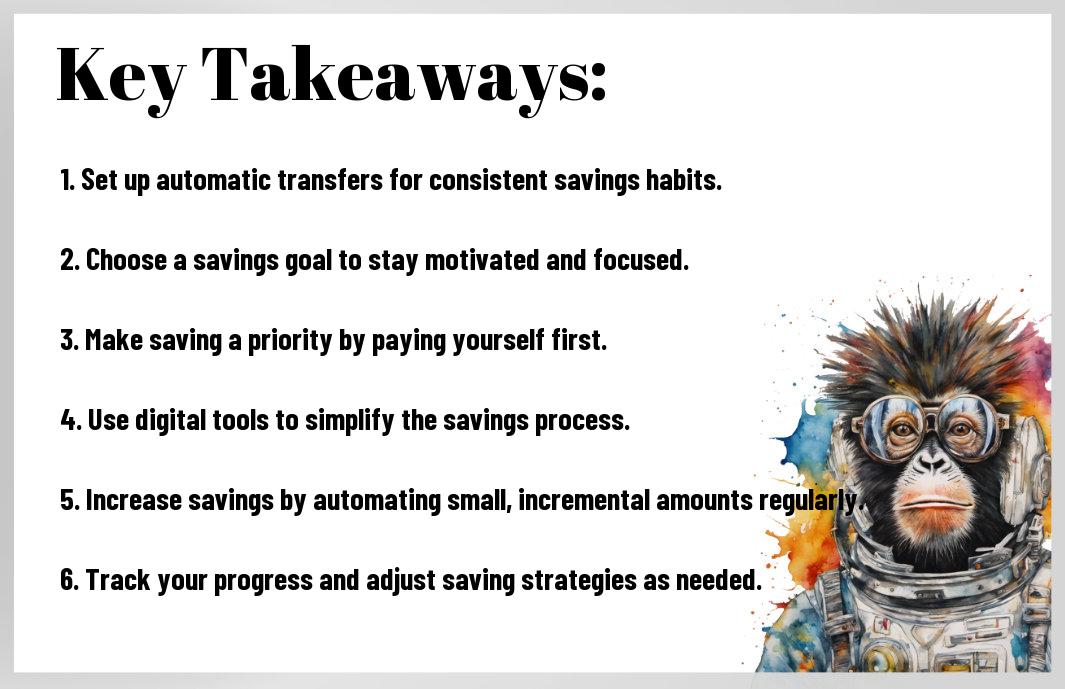

Key Takeaways:

- Set up automatic transfers: Automating your savings by setting up recurring transfers from your checking account to your savings account ensures that you consistently save money without having to think about it.

- Take advantage of employer’s retirement plan: Make sure to contribute to your employer’s retirement plan, especially if they offer a matching contribution. This is vitally free money that can help you reach your financial goals faster.

- Create separate savings accounts: Having different savings accounts for specific goals, such as emergencies, travel, or buying a home, can help you track your progress and stay motivated to save.

- Use automatic investment platforms: Consider using apps or online platforms that automatically invest your spare change or a set amount of money into stocks or funds. This can help you grow your savings over time.

- Review and adjust regularly: It’s important to review your savings goals and strategies periodically to ensure you are on track to reaching your financial goals. Adjust your automated savings plan as needed to stay aligned with your objectives.

Understanding Savings Automation

What is Savings Automation?

For many people, the idea of saving money can feel overwhelming or challenging. This is where savings automation comes into play. By setting up automated transfers from your checking account to your savings account, you can effortlessly save a portion of your income without having to think about it. It’s a simple and effective way to build your savings consistently over time.

Benefits of Automating Your Savings

Your financial goals are within reach when you automate your savings. By automating your savings, you ensure that a portion of your income is set aside before you have the chance to spend it. This helps you stick to your budget and prioritize saving without the temptation of dipping into those funds for other expenses.

Automating your savings also helps you take advantage of compound interest. By consistently saving and investing through automation, you allow your money to grow over time. This means you can reach your financial goals faster and build long-term wealth.

Setting Up Your Automated Savings Plan

Choosing the Right Savings Goals

Plan your automated savings by first determining your financial objectives. Whether you’re saving for an emergency fund, a vacation, a down payment on a house, or retirement, clearly define your goals. Having specific and achievable targets will keep you motivated and focused on your savings journey.

Selecting Automation Tools and Platforms

To streamline your automated savings plan, it is crucial to select the right tools and platforms that align with your financial goals. Look for financial institutions or apps that offer automation features like recurring transfers, round-up transactions, or percentage-based savings. Choose tools that are user-friendly and secure to ensure a seamless savings experience.

Savings tools like Acorns, Digit, or Qapital offer innovative ways to automate your savings effortlessly. These platforms use algorithms to analyze your spending patterns and save small amounts of money for you without you even noticing. By leveraging automation tools that suit your preferences, you can effortlessly grow your savings over time.

Best Practices for Automated Savings

Maximizing Savings with Automation Rules

Many individuals struggle to save consistently, but automating your savings can make it easier to reach your financial goals. By setting up specific automation rules, such as transferring a percentage of your paycheck to a separate savings account or rounding up every purchase to the nearest dollar and saving the difference, you can maximize your savings effortlessly.

Challenges: Overcoming Common Automation Challenges

Many people face challenges when it comes to automating their savings. These can include issues with setting up automatic transfers, forgetting to update savings goals, or having insufficient funds in their account for scheduled transfers. Overcoming these challenges requires careful planning, monitoring your accounts regularly, and adjusting your automation settings as needed.

Automation: Automating your savings is a powerful tool that can help you stay disciplined and consistent in reaching your financial goals. By utilizing automation features offered by banks or financial apps, you can ensure that a portion of your income goes directly towards savings without you having to actively think about it. This can help you build a solid financial foundation and make progress towards achieving your long-term goals.

Advanced Automation Strategies

- Integrating Investments into Your Automated Savings

- Using Automation for Debt Repayment and Wealth Building

Integrating Investments into Your Automated Savings

The key to achieving your financial goals faster is to not only automate your savings but also integrate investments into your strategy. By setting up automatic transfers from your checking account to investment accounts, such as Roth IRAs or index funds, you can ensure that a portion of your savings is growing over time through the power of compound interest.

Using Automation for Debt Repayment and Wealth Building

Your journey to financial freedom involves not only saving and investing but also strategically repaying debt. By automating your debt payments each month, you can ensure that you are steadily reducing your debt burden while also building wealth through your savings and investments. This dual approach will help you achieve your financial goals efficiently and effectively.

Debt repayment is a critical aspect of any financial plan. By automating your debt payments, you can avoid missing payments and incurring costly late fees or interest charges. This disciplined approach will accelerate your journey to becoming debt-free and ultimately increase your net worth over time.

Final Words

As a reminder, automating your savings is a vital tool in achieving your financial goals faster. By setting up automatic transfers to your savings account, you remove the temptation to spend that money elsewhere. Consistent savings over time can lead to significant financial growth and help you reach your goals quickly. Remember to review your savings plan regularly to ensure you are on track and making adjustments as needed. Start today and take control of your finances by automating your savings!

FAQ

Q: What are the benefits of automating your savings?

A: Automating your savings helps you stay consistent with saving money, removes the temptation to spend, and allows you to reach your financial goals faster.

Q: How can I start automating my savings?

A: You can start automating your savings by setting up automatic transfers from your checking account to your savings account on a regular basis, such as weekly or monthly.

Q: Is it safe to automate my savings?

A: Yes, automating your savings is safe as long as you use secure and reputable banking services. Make sure to set up alerts and monitor your accounts regularly for any suspicious activity.

Q: Can I adjust the amount I save when automating my savings?

A: Yes, you can adjust the amount you save by increasing or decreasing the automated transfers based on your financial situation and goals.

Q: What are some tips for maximizing the effectiveness of automated savings?

A: To maximize the effectiveness of automated savings, create a budget to determine how much you can afford to save, set specific financial goals, and regularly review your progress to stay motivated.