Trading in today’s fast-paced markets requires not only intuition but also cutting-edge tools to enhance your strategies. By integrating artificial intelligence into your trading approach, you can analyze vast amounts of data, identify patterns, and make informed decisions with precision. This blog post will guide you through innovative techniques that leverage AI technology to improve your trading performance and achieve your financial goals. Explore how tailored algorithms and machine learning can transform your decision-making process for successful trades.

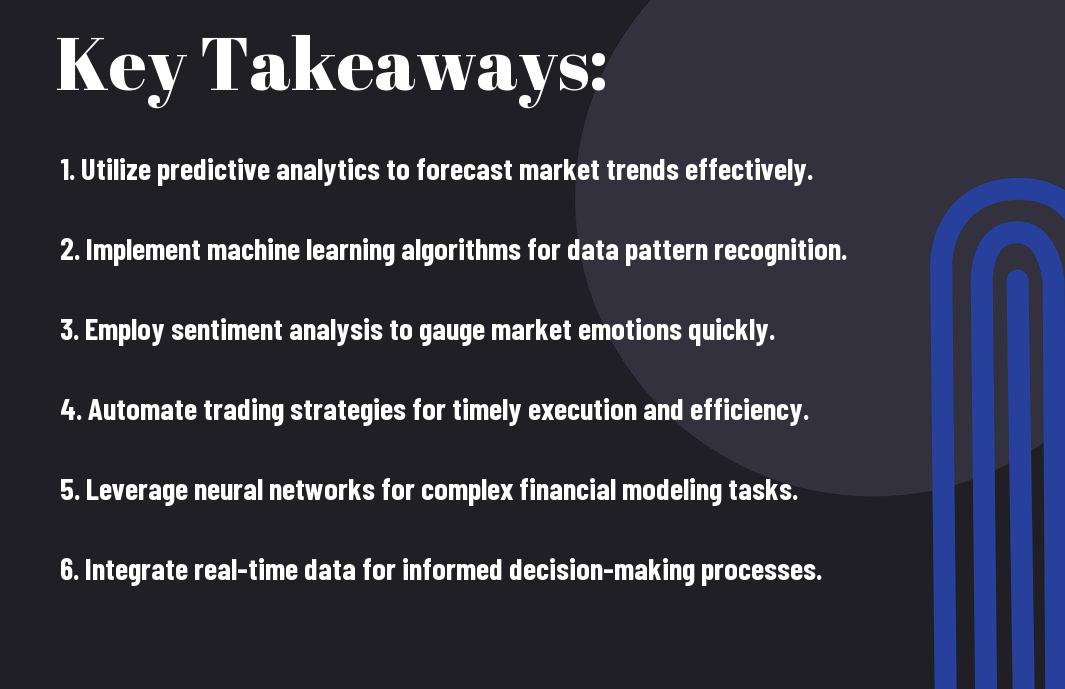

Key Takeaways:

- Data Analysis: Utilize AI algorithms for enhanced data analysis to identify trends and patterns that may not be visible through traditional methods.

- Automated Trading: Implement AI-driven automated trading systems to execute trades with precision based on real-time data, reducing emotional biases.

- Risk Management: Leverage AI tools to improve risk assessment by forecasting potential market shifts and diversifying portfolios accordingly.

- Sentiment Analysis: Apply natural language processing to analyze news articles and social media sentiment, gaining insights into public perception affecting market movements.

- Backtesting Strategies: Use AI for rigorous backtesting of trading strategies, allowing traders to refine their approaches based on historical performance data.

Understanding AI in Trading

While traditional trading methods rely heavily on human intuition and analysis, artificial intelligence (AI) revolutionizes the landscape by automating data processing and decision-making. By leveraging advanced algorithms and machine learning, AI empowers you with the ability to identify patterns, execute trades, and manage risk more efficiently. Integrating AI into your trading strategy can significantly enhance your performance and adapt to market changes in real-time.

Overview of AI Concepts

Across the spectrum of trading, AI incorporates various concepts, including machine learning, natural language processing, and neural networks. These technologies allow you to analyze vast datasets and extract meaningful insights. By harnessing the power of AI, you can optimize your trading strategies and make informed decisions based on extensive analysis rather than relying solely on historical performance or market sentiment.

Benefits of AI in Trading

Above all, AI offers several advantages in trading that can enhance your overall success. By leveraging AI technologies, you can gain access to faster and more accurate data processing, allowing you to identify opportunities and threats more easily. AI also helps you eliminate emotional biases and make data-driven decisions, increasing your chances of achieving favorable outcomes in your trades.

Also, the continuous learning capabilities of AI systems allow them to adapt to evolving market conditions, ensuring your trading strategies remain relevant. With the potential to analyze patterns across different asset classes and timeframes, AI provides you with a comprehensive view of the market landscape. This empowers you to capture opportunities that may otherwise go unnoticed, ultimately leading to better trading decisions and improved profitability.

Data Analysis Techniques

You can enhance your trading strategies by employing innovative data analysis techniques that enable you to make informed decisions. By leveraging advanced algorithms and data mining methods, you can uncover meaningful patterns and trends in financial markets. These insights can empower you to identify potential trading opportunities more effectively, ultimately optimizing your investment performance.

Predictive Analytics

On leveraging historical data and complex algorithms, predictive analytics allows you to forecast future market trends. By analyzing patterns and correlations present in the data, you can make educated predictions about stock prices and trading volumes, increasing your chances of successful trades. This forward-looking approach can be a game-changer for your trading strategy.

Sentiment Analysis

Predictive insights can be significantly bolstered by implementing sentiment analysis in your trading decisions. This technique involves examining social media, news articles, and other public sentiment to gauge market emotions. By analyzing language patterns and sentiments expressed by market participants, you can gain a comprehensive view of market psychology, helping you to anticipate potential price movements.

To effectively implement sentiment analysis, you can utilize natural language processing (NLP) tools to sift through vast amounts of qualitative data. By focusing on key indicators, such as positive or negative sentiments surrounding specific assets, you can identify trends that may influence market shifts. This allows you to proactively adapt your trading strategies, enhancing your decision-making process in volatile environments.

Machine Learning Models

Many traders are turning to machine learning models to enhance their decision-making processes. These algorithms analyze vast amounts of data, identify patterns, and make predictions that traditional methods may overlook. By incorporating machine learning into your trading strategy, you can uncover insights that lead to more informed and effective trades.

Supervised Learning

An important aspect of machine learning, supervised learning involves training algorithms on labeled datasets. This means you provide the model with input-output pairs, allowing it to learn the relationship between the two. You can use this technique to predict stock prices or classify trades, enabling you to make more precise trading decisions based on historical data.

Unsupervised Learning

Supervised learning focuses on labeled data, whereas unsupervised learning deals with datasets without explicit labels. In this approach, the algorithms analyze patterns and group similar data points, which can reveal insights about market dynamics you may not have considered otherwise. This method can help you identify underlying trends in your trading data.

For instance, you might apply unsupervised learning to cluster stocks by their price movements, allowing you to see which stocks behave similarly without relying on pre-defined categories. By uncovering these connections, you can better understand market correlations and improve your trading strategy. This technique can lead to discovering opportunities that would otherwise remain hidden in complex datasets.

Algorithmic Trading Strategies

Not all trading strategies are created equal, and integrating AI into your approach can significantly enhance your decision-making. By leveraging algorithms, you can automate trades based on predictive analysis. For insights on How AI in stock trading is altering the financial market?, explore the latest advancements that are reshaping the industry.

Designing Trading Algorithms

After identifying your trading objectives, you’ll need to design algorithms that can effectively analyze market data. This involves selecting relevant indicators and creating a comprehensive strategy that reflects your investment goals.

Backtesting Strategies

To ensure that your algorithms perform well under various market conditions, backtesting is crucial. This process allows you to simulate trades using historical data, helping you refine your approach before committing real capital.

And as you analyze the backtesting results, you’ll gain valuable insights into the efficacy of your trading algorithms. This allows you to tweak parameters and strategies, ensuring that your systems are not only effective in theory but also in practice. By conducting thorough backtests, you can build confidence in your trading decisions and harness the full potential of AI in enhancing your trading performance.

Risk Management with AI

Now, incorporating AI into your trading strategy can significantly enhance your risk management practices. By leveraging advanced algorithms and data analytics, you can gain a deeper understanding of potential risks, enabling you to make more informed decisions. This proactive approach allows you to identify vulnerabilities in your portfolio and adjust accordingly, providing a solid foundation for long-term success in trading.

Identifying Risks

After deploying AI tools, you will be able to systematically identify risks that may impact your trading strategies. AI algorithms analyze vast amounts of historical and current market data, helping you recognize patterns and anomalies that could indicate potential threats. By pinpointing these risks early on, you can take proactive measures to safeguard your investments.

Mitigation Strategies

Behind effective risk management lies the implementation of robust mitigation strategies, powered by AI insights. These strategies can involve diversifying your portfolio or adjusting trade sizes based on predictive analyses. With AI, you can simulate various market scenarios to understand potential impacts and craft specific actions to minimize exposure.

At the heart of successful risk mitigation is your ability to adapt based on real-time data. By utilizing AI-driven simulations, you can assess the potential consequences of different trading decisions, allowing you to create tailored strategies that align with your risk tolerance. This dynamic approach enables you to navigate market fluctuations with confidence and maintain better control over your trading outcomes.

Real-World Applications of AI in Trading

Unlike traditional trading methods, AI enhances your decision-making process through advanced algorithms and predictive analytics. By leveraging AI, you can analyze vast datasets quickly, optimizing your strategies effectively. To learn more, check out AI Trading: How AI Is Used in Stock Trading, which discusses various implementations in the financial sector.

Case Studies

Behind many successful trading strategies are real-world applications of AI that demonstrate its effectiveness:

- A investment firm reported a 30% increase in returns by integrating AI-based trading models.

- Another case shows a hedge fund utilizing AI to predict market trends with a 85% accuracy rate.

- One algorithmic trading platform achieved a 50% reduction in market risk exposure through machine learning.

- A retail brokerage using AI automated customer trades, leading to a 40% uptick in client engagement.

Tools and Platforms

About your trading journey, understanding the tools and platforms available can significantly enhance your performance. Many cutting-edge solutions offer AI-driven analytics, backtesting capabilities, and real-time data processing. These tools can streamline your workflow, ensuring you capitalize on timely opportunities.

Plus, leveraging robust platforms can help you seamlessly implement complex algorithms and trade simulations. By using these advanced tools, you can enhance your trading strategies, aligning them more closely with market dynamics and maximizing your investment potential.

Summing up

Hence, by integrating innovative AI techniques into your trading strategies, you can significantly enhance your decision-making process. Utilize data analytics, machine learning models, and algorithmic trading systems to analyze market trends and predict price movements more accurately. Embracing these technologies will empower you to make more informed trades, reduce risks, and optimize your overall performance in the ever-evolving financial landscape. Stay ahead of the curve by continually exploring new tools and methodologies to keep your trading approach fresh and effective.

FAQ

Q: What are the primary benefits of applying AI in trading decisions?

A: AI can analyze vast amounts of data at unprecedented speeds, providing insights that may not be immediately obvious to human traders. This technology helps identify patterns, predict market trends, and execute trades more efficiently. Furthermore, AI systems can continuously learn and adapt to new data, allowing for more informed decision-making over time.

Q: How can traders start integrating AI into their trading strategies?

A: Traders can begin by exploring AI-driven trading platforms or software that offer machine learning capabilities. It is beneficial to study the types of algorithms in use, such as regression analysis, decision trees, or neural networks. Additionally, engaging with educational resources or online courses focused on AI in finance can enhance understanding and implementation skills.

Q: What data sources are most useful for AI in trading?

A: AI algorithms thrive on diverse data sets for optimal performance. Key sources include historical price data, trading volume, socio-economic indicators, and news sentiment analysis. Incorporating alternative data, such as social media trends and satellite imagery, can provide a unique edge in predicting market behavior.

Q: Are there any risks associated with using AI in trading?

A: Yes, while AI can enhance trading decisions, it also carries risks. Models may misinterpret data or fail to account for unforeseen market events, leading to inaccurate predictions. Additionally, overreliance on AI can reduce a trader’s ability to make independent decisions, resulting in potential losses. It’s important to balance AI insights with personal judgment and market knowledge.

Q: How can traders assess the performance of their AI-driven strategies?

A: To evaluate the effectiveness of AI trading strategies, traders should establish clear performance metrics such as return on investment (ROI), win-to-loss ratio, and drawdown periods. Regular backtesting against historical data and maintaining a robust log of trades can offer insights into how well the strategy is performing over time. Additionally, continuous tuning of algorithms based on performance feedback is vital for sustained success.