Many financial institutions are turning to neural networks as a cutting-edge tool for predictive analytics in banking. These powerful algorithms are revolutionizing the way banks analyze data and forecast trends. By leveraging complex patterns and relationships within vast datasets, neural networks offer unparalleled accuracy in predicting customer behavior, market trends, and risk assessment. To learn more about how neural networks can be harnessed for predicting future events, check out this informative article on How can neural networks be used to predict future events?.

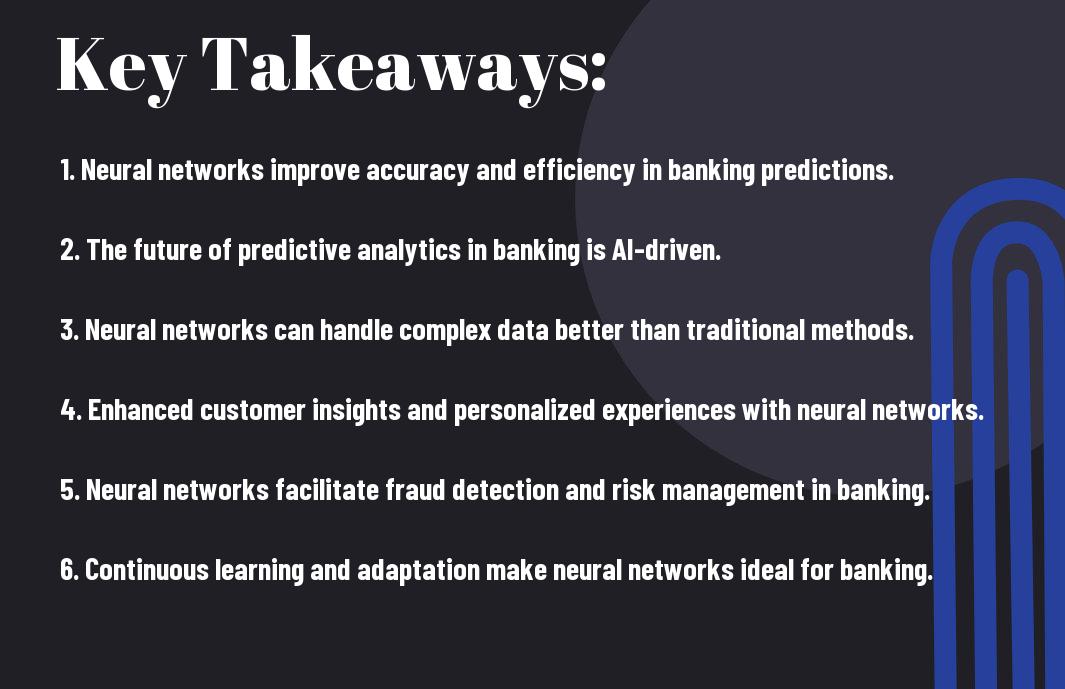

Key Takeaways:

- Neural networks offer highly accurate predictions: Neural networks excel at recognizing complex patterns in data, providing more accurate predictions in banking scenarios.

- Enhanced risk assessment: Utilizing neural networks can significantly improve risk assessment in banking by analyzing multiple data points simultaneously.

- Improved fraud detection: By detecting irregular patterns and anomalies, neural networks can enhance fraud detection processes in banking systems.

- Personalized customer experiences: Neural networks enable banks to offer tailored services to customers based on their transaction history and preferences.

- Efficient decision-making: Neural networks can quickly analyze vast amounts of data, assisting banks in making faster, more informed decisions.

- Adaptability to changing trends: Neural networks can adapt to changing market trends and customer behaviors, helping banks stay competitive in the industry.

- Integration with automation: Neural networks can be integrated with automation processes to streamline operations and enhance efficiency in banking operations.

The Role of Neural Networks in Predictive Analytics

Understanding Predictive Analytics

An vital component of modern data analysis, predictive analytics involves using historical data to predict future outcomes. By leveraging statistical algorithms and machine learning techniques, predictive analytics can help identify patterns and trends that can aid in making informed decisions and forecasts.

Advantages of Neural Networks in Data Analysis

Advantages of neural networks in data analysis are plentiful. Neural networks are highly adept at handling complex data sets and extracting relevant patterns that may not be apparent through traditional analysis methods. With their ability to learn from data and adapt to changing parameters, neural networks offer a powerful tool for uncovering valuable insights in large and diverse data sets.

To fully leverage the advantages of neural networks in data analysis, it is crucial for banking institutions to invest in robust data infrastructure and skilled data scientists who can effectively develop and deploy neural network models. Ultimately, the successful integration of neural networks in predictive analytics can significantly enhance a bank’s ability to make data-driven decisions and stay ahead in an increasingly competitive market.

Neural Networks in Risk Assessment

Credit Scoring Models

Now, one of the key applications of neural networks in risk assessment is in credit scoring models. These models analyze an individual’s credit history, payment behavior, and other financial data to predict their likelihood of defaulting on a loan. Neural networks can process vast amounts of data and identify intricate patterns that traditional models may overlook, resulting in more accurate risk assessments.

Fraud Detection and Prevention

Scoring fraud detection and prevention using neural networks has revolutionized the banking industry’s security measures. These advanced algorithms can swiftly analyze significant volumes of transactions in real-time, flagging suspicious activities and potential fraud attempts. By using neural networks, banks can proactively combat fraudulent behavior and protect their customers from financial harm.

The utilization of neural networks in risk assessment showcases the potential for more sophisticated and efficient predictive analytics in the banking sector. With their ability to handle complex data sets and detect subtle patterns, neural networks offer a promising avenue for enhancing risk management practices and safeguarding financial institutions from potential threats.

Operational Efficiency and Customer Experience

Personalized Banking Services

Many banks are turning to neural networks to enhance their operational efficiency and improve customer experience. By leveraging predictive analytics, banks can offer personalized banking services tailored to individual customer needs. This allows for more targeted marketing strategies, customized product recommendations, and better customer engagement.

Predictive Maintenance in Banking Infrastructure

Operational efficiency is crucial in the banking sector, and predictive maintenance plays a key role in ensuring smooth operations. By using neural networks to predict potential failures in banking infrastructure, institutions can proactively address issues before they escalate. This proactive approach not only minimizes downtime but also saves costs associated with reactive maintenance.

With the help of neural networks, banks can analyze vast amounts of data in real-time to identify patterns and trends that signal potential equipment failures. This proactive maintenance strategy not only ensures operational efficiency but also enhances overall customer experience by minimizing disruptions and ensuring continuous service availability.

Challenges and Considerations

Data Privacy and Security

Not to be overlooked in the integration of neural networks for predictive analytics in banking is the crucial aspect of data privacy and security. Any breach or misuse of sensitive customer information can lead to significant financial and reputational damage for the bank.

Technical and Resource Constraints

Constraints in terms of technical expertise and resources can hinder the full adoption of neural networks in predictive analytics within the banking sector. Plus, the implementation of these complex systems requires a substantial investment in both technology and human capital to ensure optimal performance and compliance with regulatory requirements.

Future Trends and Developments

Integration with Other Emerging Technologies

Future integration of neural networks with other emerging technologies such as blockchain, Internet of Things (IoT), and quantum computing holds the key to revolutionizing predictive analytics in the banking sector. By combining the power of neural networks with these technologies, banks can gain deeper insights into customer behavior, improve risk management, and enhance personalized services.

Regulatory Implications and Ethical Concerns

Any advancements in predictive analytics using neural networks must also address regulatory implications and ethical concerns. As banks rely more on artificial intelligence for decision-making, there is a growing need for transparent algorithms, data privacy protection, and fair use of customer data. Regulatory bodies are increasingly focusing on ensuring that AI applications in banking adhere to legal frameworks and ethical standards.

With the rapid evolution of predictive analytics in banking, the need for stringent regulations and ethical guidelines becomes more critical. Banks must collaborate with regulators, data protection authorities, and industry stakeholders to establish robust governance mechanisms that uphold customer trust and data security.

Summing up

Taking this into account, it is evident that neural networks are indeed the future of predictive analytics in banking. With their ability to process vast amounts of data and identify complex patterns, neural networks offer banks a powerful tool to make more accurate forecasts, reduce risks, and improve decision-making processes. As technology continues to evolve, integrating neural networks into banking practices will become necessary for staying competitive in the industry. Embracing this technology will not only lead to more efficient operations but also pave the way for a more personalized and seamless customer experience.

FAQ

Q: What are Neural Networks?

A: Neural Networks are a type of machine learning algorithm that is modeled after the human brain. They consist of interconnected nodes, or artificial neurons, that process information and make predictions based on patterns in the data.

Q: How are Neural Networks used in Predictive Analytics in Banking?

A: In banking, Neural Networks are used to analyze large amounts of data to predict customer behavior, detect fraud, assess credit risk, and personalize marketing campaigns. They help banks make more informed decisions and improve customer satisfaction.

Q: What are the advantages of using Neural Networks in Banking?

A: Neural Networks offer high accuracy in predicting outcomes, the ability to process large and complex data sets, real-time decision-making capabilities, and the potential to automate repetitive tasks. They help banks optimize operations, reduce risks, and enhance customer experience.

Q: Are Neural Networks the future of Predictive Analytics in Banking?

A: Yes, Neural Networks are considered the future of Predictive Analytics in Banking due to their advanced capabilities in processing big data, identifying complex patterns, and making accurate predictions. As technology continues to evolve, Neural Networks will play a crucial role in shaping the future of banking analytics.

Q: What are some challenges in implementing Neural Networks in Banking?

A: Challenges in implementing Neural Networks in banking include the need for skilled data scientists, ensuring data privacy and security, integrating with existing systems, and explaining the model outputs for regulatory compliance. Overcoming these challenges is necessary for banks to fully leverage the power of Neural Networks in predictive analytics.